Hi

Hi @David Harper CFA FRM

Was working on this one last night.

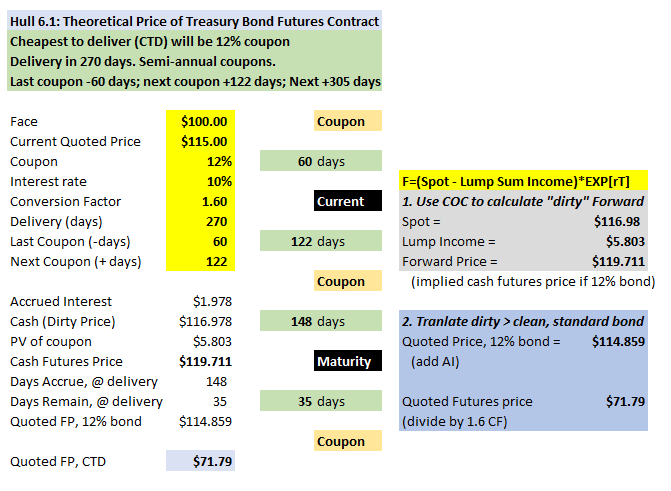

PV of the coupon, $5.803.

Could not get this.

Got $5.73x and tried again and calculating $5.85x

What am I doing wrong here? I am assuming I am doing something wrong here with the day counts.

thanks

Hi @David Harper CFA FRM

Was working on this one last night.

PV of the coupon, $5.803.

Could not get this.

Got $5.73x and tried again and calculating $5.85x

What am I doing wrong here? I am assuming I am doing something wrong here with the day counts.

thanks

but I hope my musing is helpful!

but I hope my musing is helpful!