Learning objectives: Describe Grinold’s fundamental law of active management, including its assumptions and limitations, and calculate the information ratio using this law. Apply a factor regression to construct a benchmark with multiple factors, measure a portfolio’s sensitivity to those factors and measure alpha against that benchmark.

Questions:

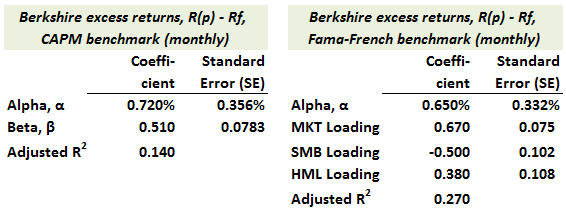

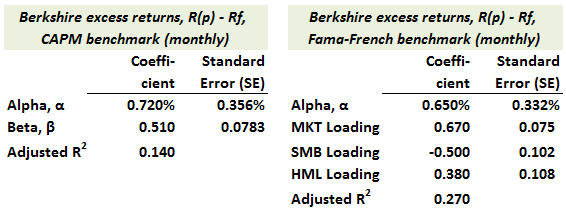

705.1. Below are displayed the actual results for two of Andrew Ang's regressions of Warren Buffett's Berkshire Hathaway (from 1990 to 2012). On the left is his regression of Berkshire's monthly excess returns against the capital asset pricing model (CAPM) benchmark. On the right is his regression of Berkshire's monthly excess returns against the three-factor (MKT, SMB and HML) Fama-French benchmark:

Please note these are excess returns, R(p) - Rf. About these actual regression results, each of the following statements is true EXCEPT which is false?

a. The -0.50 SMB factor loading and +0.380 HML factor loading imply the Berkshire Hathaway is a large-cap, value investor

b. Berkshire generates significant alpha with at least 90.0% confidence, and the addition of the size (SMB) and value (HML) does IMPROVE the fit of the regression model

c. The statistically insignificant alphas, low coefficients of determination (adjusted R^2), and increase in market beta (from 0.510 to 0.670) when SMB and HML factors are added suggest that Berkshire did not generate sustained alpha

d. The benchmark implied by the Fama–French regression estimates is given by: $0.33 in T-bills + $0.67 in the market portfolio + (long $0.50 in large caps - short $0.50 in small caps) + ($0.38 in value stocks - $0.38 in growth stocks)

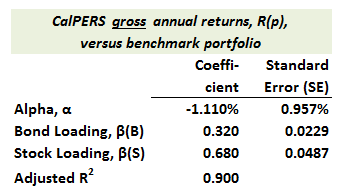

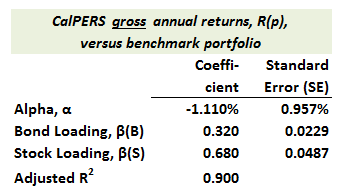

705.2. Below are Andrew Ang's actual regression results for the annual gross returns of the CalPERS pension fund against a passive portfolio of index funds in stocks and bonds. Please note the returns are gross returns, not excess returns; i.e., they are NOT net of the riskfree rate.

Which of the following statements about these regression results is TRUE?

a. The high adjusted R^2 validates a hypothesis that the CalPERS active fund managers do add value relative to the benchmark

b. Because the factor loadings are not statistically significant, different factors should be repeatedly tested until a set is found that is significant

c. This regression should be re-run with at least one additional factor because robust benchmark portfolios must include at least one risk-free asset

d. It is acceptable to exclude risk-free assets and regress gross returns against the benchmark portfolio conditional on a constraint that the factor loadings sum to one; in this case, we need β(B) + β(S) = 1.0

705.3. Andrew Ang tells us that a portfolio manager creates alpha relative to a benchmark by making bets that deviate from that benchmark. The more successful these bets, the higher the manager's alpha. Grinold’s Fundamental Law of Active Management formalizes this intuition by asserting that the maximum attainable information ratio is given by IR ≈ IC * sqrt(BR) where IR is the information ratio, IC is the information coefficient (the correlation of the manager’s forecast with the actual returns) and BR is the breadth of the strategy. Breadth is the number of securities that can be traded and how frequently they can be traded.

According to Ang, each of the following statements about the Fundamental Law is true EXCEPT which is false?

a. The empirical evidence suggests that, on average, IC tends to fall as BR increases

b. A compelling advantage of the fundamental law is that it successfully incorporates downside risk and higher moment risk; specifically, it adjusts for skew and excess kurtosis

c. If we require an IR of 0.50, this can be achieved either by a highly skilled stock timer with an IC of 0.25 making only four bets a year; or the same IR can be achieved by a manager with only a slight edge, IC of 0.025, who makes fully 400 bets a year

d. A crucial assumption is that the forecasts are independent of each other. But due to realistically correlated factor bets, it is difficult to make truly independent forecasts in BR; e.g., an equity manager with overweight positions on 1,000 value stocks offset by underweight positions in 1,000 growth stocks has not placed 1,000 different bets

Answers here:

Questions:

705.1. Below are displayed the actual results for two of Andrew Ang's regressions of Warren Buffett's Berkshire Hathaway (from 1990 to 2012). On the left is his regression of Berkshire's monthly excess returns against the capital asset pricing model (CAPM) benchmark. On the right is his regression of Berkshire's monthly excess returns against the three-factor (MKT, SMB and HML) Fama-French benchmark:

Please note these are excess returns, R(p) - Rf. About these actual regression results, each of the following statements is true EXCEPT which is false?

a. The -0.50 SMB factor loading and +0.380 HML factor loading imply the Berkshire Hathaway is a large-cap, value investor

b. Berkshire generates significant alpha with at least 90.0% confidence, and the addition of the size (SMB) and value (HML) does IMPROVE the fit of the regression model

c. The statistically insignificant alphas, low coefficients of determination (adjusted R^2), and increase in market beta (from 0.510 to 0.670) when SMB and HML factors are added suggest that Berkshire did not generate sustained alpha

d. The benchmark implied by the Fama–French regression estimates is given by: $0.33 in T-bills + $0.67 in the market portfolio + (long $0.50 in large caps - short $0.50 in small caps) + ($0.38 in value stocks - $0.38 in growth stocks)

705.2. Below are Andrew Ang's actual regression results for the annual gross returns of the CalPERS pension fund against a passive portfolio of index funds in stocks and bonds. Please note the returns are gross returns, not excess returns; i.e., they are NOT net of the riskfree rate.

Which of the following statements about these regression results is TRUE?

a. The high adjusted R^2 validates a hypothesis that the CalPERS active fund managers do add value relative to the benchmark

b. Because the factor loadings are not statistically significant, different factors should be repeatedly tested until a set is found that is significant

c. This regression should be re-run with at least one additional factor because robust benchmark portfolios must include at least one risk-free asset

d. It is acceptable to exclude risk-free assets and regress gross returns against the benchmark portfolio conditional on a constraint that the factor loadings sum to one; in this case, we need β(B) + β(S) = 1.0

705.3. Andrew Ang tells us that a portfolio manager creates alpha relative to a benchmark by making bets that deviate from that benchmark. The more successful these bets, the higher the manager's alpha. Grinold’s Fundamental Law of Active Management formalizes this intuition by asserting that the maximum attainable information ratio is given by IR ≈ IC * sqrt(BR) where IR is the information ratio, IC is the information coefficient (the correlation of the manager’s forecast with the actual returns) and BR is the breadth of the strategy. Breadth is the number of securities that can be traded and how frequently they can be traded.

According to Ang, each of the following statements about the Fundamental Law is true EXCEPT which is false?

a. The empirical evidence suggests that, on average, IC tends to fall as BR increases

b. A compelling advantage of the fundamental law is that it successfully incorporates downside risk and higher moment risk; specifically, it adjusts for skew and excess kurtosis

c. If we require an IR of 0.50, this can be achieved either by a highly skilled stock timer with an IC of 0.25 making only four bets a year; or the same IR can be achieved by a manager with only a slight edge, IC of 0.025, who makes fully 400 bets a year

d. A crucial assumption is that the forecasts are independent of each other. But due to realistically correlated factor bets, it is difficult to make truly independent forecasts in BR; e.g., an equity manager with overweight positions on 1,000 value stocks offset by underweight positions in 1,000 growth stocks has not placed 1,000 different bets

Answers here:

Last edited by a moderator:

)

)