Questions:

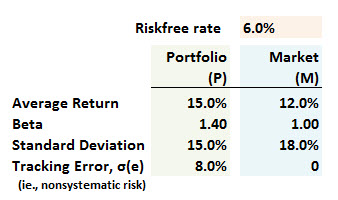

404.1. Consider the following performance data comparing a portfolio to its benchmark, the market, for a sample period:

What is the portfolio's information ratio (IR) of the portfolio?

a. 0.075

b. 0.525

c. 0.760

d. 1.857

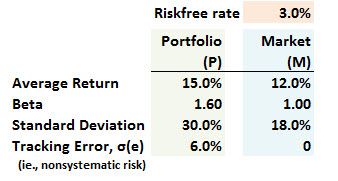

404.2. Consider the following performance data comparing a portfolio to its benchmark, the market, for a sample period:

What is the portfolio's M-squared (M^2) measure?

a. -1.80%

b. 0.35%

c. 1.27%

d. 2.69%

404.3. Over an historical measurement period, a long/short equity hedge fund produced an alpha of +100 basis points per month. The monthly standard deviation of the residual (non-systemic) risk was only 5.0%. If we want a two-tailed 95% significance level, approximately how many years (N) are required to determine that the fund demonstrated skill, that is, such that we can reject the null hypothesis that his true alpha is zero?

a. 2 years

b. 8 years

c. 15 years

d. 37 years

Answers here:

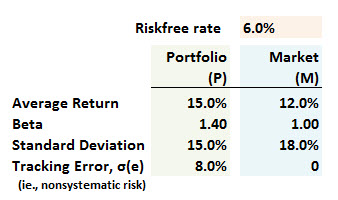

404.1. Consider the following performance data comparing a portfolio to its benchmark, the market, for a sample period:

What is the portfolio's information ratio (IR) of the portfolio?

a. 0.075

b. 0.525

c. 0.760

d. 1.857

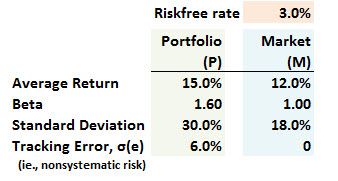

404.2. Consider the following performance data comparing a portfolio to its benchmark, the market, for a sample period:

What is the portfolio's M-squared (M^2) measure?

a. -1.80%

b. 0.35%

c. 1.27%

d. 2.69%

404.3. Over an historical measurement period, a long/short equity hedge fund produced an alpha of +100 basis points per month. The monthly standard deviation of the residual (non-systemic) risk was only 5.0%. If we want a two-tailed 95% significance level, approximately how many years (N) are required to determine that the fund demonstrated skill, that is, such that we can reject the null hypothesis that his true alpha is zero?

a. 2 years

b. 8 years

c. 15 years

d. 37 years

Answers here: