Questions:

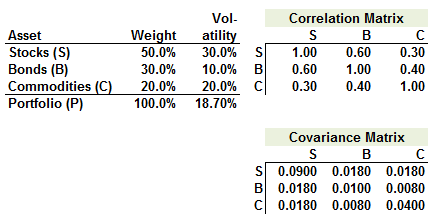

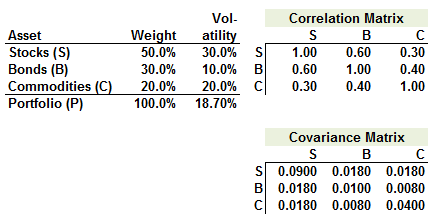

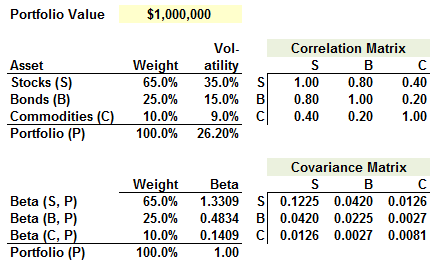

401.1. Consider the following three-asset portfolio and its correlation/covariance matrices:

An asset's marginal risk (MRISK) is the asset's beta, with respect to the portfolio which includes the asset, multiplied by portfolio volatility; e.g., MRISK(S) = COV(S,P)/Variance(P)*Volatility(P) = COV(S, P)/Volatility(P). An asset's risk contribution (CRISK) is its marginal risk multiplied by it's weight; e.g., CRISK(S) = MRISK(S)*weight%(S). Risk contributions must sum to portfolio volatility (is their virtue!). Marginal VaR is MRISK scaled by the confidence level deviate; Component VaR is CRISK scaled by the deviate.

In the three-asset portfolio above, which is nearest to the risk contribution of the commodities (C) asset?

a. 2.075%

b. 3.740%

c. 4.938%

d. 5.010%

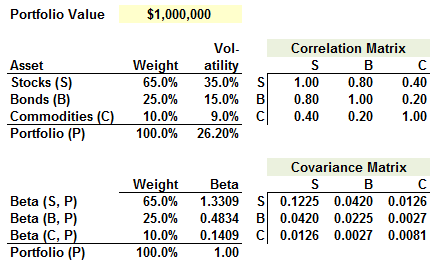

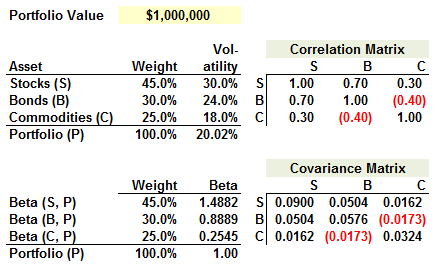

401.2. Consider the following three-asset portfolio (which assumes returns are multivariate normal):

Which is nearest to the 95.0% component value at risk (VaR) of the bonds (B) position?

a. $17,800

b. $52,000

c. $93,500

d. $184,400

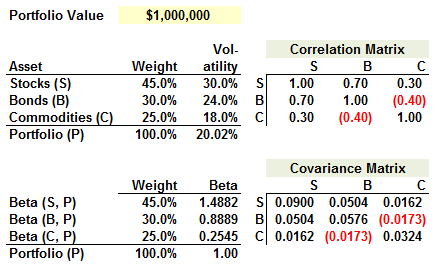

401.3. Consider the following three-asset portfolio:

Each of the following statements is true EXCEPT which is false?

a. The 99.0% portfolio VaR is roughly $466,000

b. The stock (S) position has the highest 99.0% marginal VaR and the highest 99.0% component VaR, of the three positions

c. The commodities (C) position has a negative 99.0% marginal VaR

d. The incremental VaR of the commodity position is less than its component VaR

Answers:

401.1. Consider the following three-asset portfolio and its correlation/covariance matrices:

An asset's marginal risk (MRISK) is the asset's beta, with respect to the portfolio which includes the asset, multiplied by portfolio volatility; e.g., MRISK(S) = COV(S,P)/Variance(P)*Volatility(P) = COV(S, P)/Volatility(P). An asset's risk contribution (CRISK) is its marginal risk multiplied by it's weight; e.g., CRISK(S) = MRISK(S)*weight%(S). Risk contributions must sum to portfolio volatility (is their virtue!). Marginal VaR is MRISK scaled by the confidence level deviate; Component VaR is CRISK scaled by the deviate.

In the three-asset portfolio above, which is nearest to the risk contribution of the commodities (C) asset?

a. 2.075%

b. 3.740%

c. 4.938%

d. 5.010%

401.2. Consider the following three-asset portfolio (which assumes returns are multivariate normal):

Which is nearest to the 95.0% component value at risk (VaR) of the bonds (B) position?

a. $17,800

b. $52,000

c. $93,500

d. $184,400

401.3. Consider the following three-asset portfolio:

Each of the following statements is true EXCEPT which is false?

a. The 99.0% portfolio VaR is roughly $466,000

b. The stock (S) position has the highest 99.0% marginal VaR and the highest 99.0% component VaR, of the three positions

c. The commodities (C) position has a negative 99.0% marginal VaR

d. The incremental VaR of the commodity position is less than its component VaR

Answers:

Last edited: