Learning objectives: Estimate a bank’s liquidity needs through three methods (sources and uses of funds, structure of funds and liquidity indicators). Summarize the process taken by a US bank to calculate its legal reserves. Differentiate between factors that affect the choice among alternate sources of reserves

Questions:

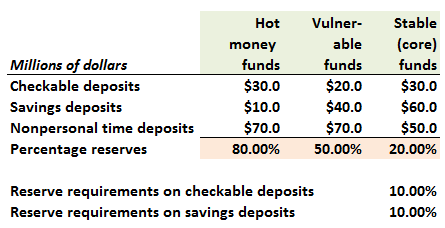

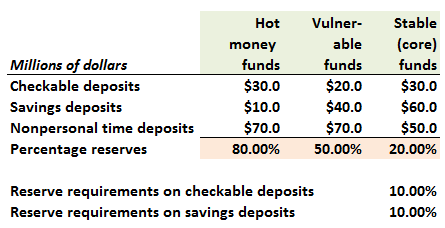

20.7.1. Kingstreet Savings is attempting to determine its liquidity requirement. The bank has classified its checking, savings, and nonperson time deposits (which total $380.0 million in deposits) into three categories: hot money, vulnerable, and stable (aka, core) funds:

The total liquidity requirement is the sum of the liability and loan requirements, but we are here ignoring the loan liquidity requirement; further, the reserve requirements are not necessarily realistic but instead are rounded for the sake of more convenient calculations. Management has elected to hold an 80.0% reserve in liquid assets or borrowing capacity for each dollar of hot money deposits, a 50.0% reserve behind vulnerable deposits, and a 20.0% reserve for its holdings of core funds. The legal reserve requirement is 10.0% for both checkable and savings deposits; nonpersonal time deposits have zero legal reserve requirements.

Kingstreet Savings is using the Structure of Funds approach to estimating its liquidity requirement. What is Kingstreet's net deposit liquidity requirement for the (total of) vulnerable funds?

a. $13.0 million

b. $30.0 million

c. $62.0 million

d. $177.0 million

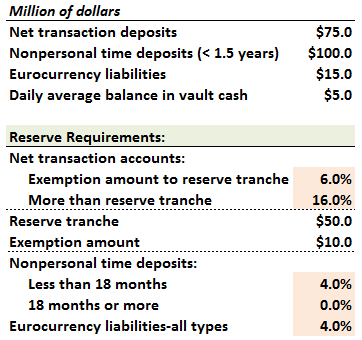

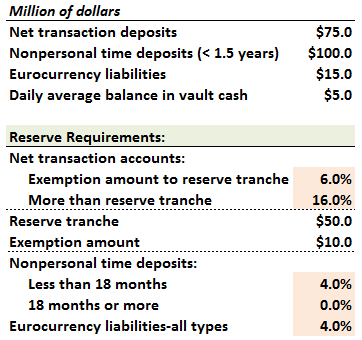

20.7.2. Acme Bank and Trust has below calculated its daily average deposits and vault cash holdings (ie, $5.0 million) for the most recent two-week computation period. Also shown are decidedly hypothetical (ie, not necessarily realistic) reserve requirements posted by the Federal Reserve System:

What is the bank's Daily Average Reserve holdings at the Federal Reserve bank (FRB)?

a. $6.0 million

b. $9.5 million

c. $12.5 million

d. $23.0 million

20.7.3. Below are five of the ten liquidity indicators defined in Rose and Hudgins (the other five are Cash position, Liquid securities, Net federal funds and repurchase agreements position, Deposit brokerage index, and Loan commitments ratio).

Among the five liquidity indicators listed above, in addition to the Core deposit ratio, which is a POSITIVE liquidity indicator; for which would an unexpected drop maybe be a yellow- or red-flag cause for concern?

a. Capacity ratio

b. Hot money ratio

c. Pledged securities ratio

d. Deposit composition ratio

Answers here:

Questions:

20.7.1. Kingstreet Savings is attempting to determine its liquidity requirement. The bank has classified its checking, savings, and nonperson time deposits (which total $380.0 million in deposits) into three categories: hot money, vulnerable, and stable (aka, core) funds:

The total liquidity requirement is the sum of the liability and loan requirements, but we are here ignoring the loan liquidity requirement; further, the reserve requirements are not necessarily realistic but instead are rounded for the sake of more convenient calculations. Management has elected to hold an 80.0% reserve in liquid assets or borrowing capacity for each dollar of hot money deposits, a 50.0% reserve behind vulnerable deposits, and a 20.0% reserve for its holdings of core funds. The legal reserve requirement is 10.0% for both checkable and savings deposits; nonpersonal time deposits have zero legal reserve requirements.

Kingstreet Savings is using the Structure of Funds approach to estimating its liquidity requirement. What is Kingstreet's net deposit liquidity requirement for the (total of) vulnerable funds?

a. $13.0 million

b. $30.0 million

c. $62.0 million

d. $177.0 million

20.7.2. Acme Bank and Trust has below calculated its daily average deposits and vault cash holdings (ie, $5.0 million) for the most recent two-week computation period. Also shown are decidedly hypothetical (ie, not necessarily realistic) reserve requirements posted by the Federal Reserve System:

What is the bank's Daily Average Reserve holdings at the Federal Reserve bank (FRB)?

a. $6.0 million

b. $9.5 million

c. $12.5 million

d. $23.0 million

20.7.3. Below are five of the ten liquidity indicators defined in Rose and Hudgins (the other five are Cash position, Liquid securities, Net federal funds and repurchase agreements position, Deposit brokerage index, and Loan commitments ratio).

- Capacity ratio = Net loans and leases divided by Total assets (-)

- Pledged securities ratio = Pledged securities divided by Total Assets (-)

- Hot money ratio = Money market assets divided by Volatile liabilities (+)

- Core deposit ratio = Core deposits divided by Total assets (+)

- Deposit composition ratio = Demand deposits divided by Time deposits (-)

Among the five liquidity indicators listed above, in addition to the Core deposit ratio, which is a POSITIVE liquidity indicator; for which would an unexpected drop maybe be a yellow- or red-flag cause for concern?

a. Capacity ratio

b. Hot money ratio

c. Pledged securities ratio

d. Deposit composition ratio

Answers here:

Last edited by a moderator: