AIM: Describe the uses for the Modigliani-squared and Treynor’s measure in comparing two portfolios, and the graphical representation of these measures.

Questions:

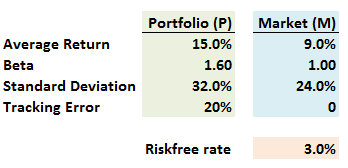

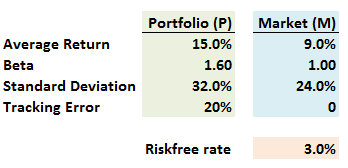

17.1. The following data compares a Portfolio (P) to the Market (M):

What is Modigliani-squared (M^2) measure of the portfolio?

a. -2.5%

b. +0.5%

c. +3.0%

d. +6.0%

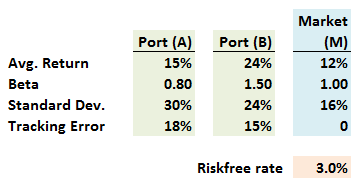

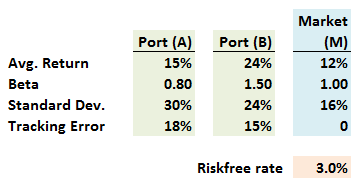

17.2. The following data compares two portfolios, Portfolio (A) and Portfolio (B), to the Market(M):

If we rank the portfolios according to, respectively, the Modigliani-squared (M^2) measure and slope of the T-line (equalizing for beta), how do the portfolios rank against each other?

a. Portfolio (A) offers both a higher M^2 and steeper T-line than Portfolio (B)

b. Portfolio (A) offers a higher M^2, but Portfolio (B) has a steeper T-line

c. Portfolio (B) offers a higher M^2, but Portfolio (A) has a steeper T-line

d. Portfolio (B) offers both a higher M^2 and steeper T-line than Portfolio (A)

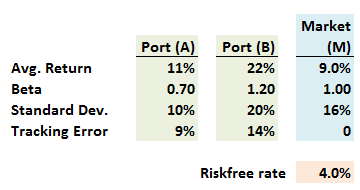

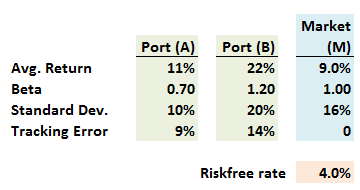

17.3. The following data compares two portfolios, Portfolio (A) and Portfolio (B), to the Market(M):

What are, respectively, the Treynor-squared (T^2) measure of Portfolio (A) and Portfolio (B)?

a. T^2(A) = -1.0% and T^2(B) = 1.7%

b. T^2(A) = 1.0% and T^2(B) = 2.8%

c. T^2(A) = 3.0% and T^2(B) = 7.5%

d. T^2(A) = 5.0% and T^2(B) = 10.0%

Answers:

Questions:

17.1. The following data compares a Portfolio (P) to the Market (M):

What is Modigliani-squared (M^2) measure of the portfolio?

a. -2.5%

b. +0.5%

c. +3.0%

d. +6.0%

17.2. The following data compares two portfolios, Portfolio (A) and Portfolio (B), to the Market(M):

If we rank the portfolios according to, respectively, the Modigliani-squared (M^2) measure and slope of the T-line (equalizing for beta), how do the portfolios rank against each other?

a. Portfolio (A) offers both a higher M^2 and steeper T-line than Portfolio (B)

b. Portfolio (A) offers a higher M^2, but Portfolio (B) has a steeper T-line

c. Portfolio (B) offers a higher M^2, but Portfolio (A) has a steeper T-line

d. Portfolio (B) offers both a higher M^2 and steeper T-line than Portfolio (A)

17.3. The following data compares two portfolios, Portfolio (A) and Portfolio (B), to the Market(M):

What are, respectively, the Treynor-squared (T^2) measure of Portfolio (A) and Portfolio (B)?

a. T^2(A) = -1.0% and T^2(B) = 1.7%

b. T^2(A) = 1.0% and T^2(B) = 2.8%

c. T^2(A) = 3.0% and T^2(B) = 7.5%

d. T^2(A) = 5.0% and T^2(B) = 10.0%

Answers: