Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

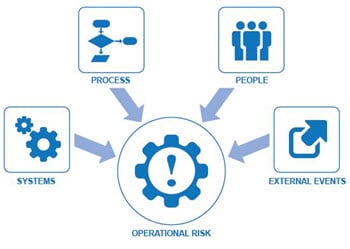

700.1. Zoomplanet is a large company in the retail sector and Peter is drafting the first version of the company's Operational Risk Register. The Operational Risk Register (aka, risk log) is a repository of each operational risk identified within the company and will be used in the operational risk management process. Peter starts by analyzing a list of Zoomplanet's historical loss events in order to identify possible OPERATIONAL risk loss event categories. Each of the following is an operational risk loss event EXCEPT which is NOT an operational risk but instead PROBABLY belongs in a different category?

a. Climate change induced flash floods in the Asian region where Zoomplanet's suppliers are located which disrupted Zoomplanet's supply chain

b. Amazon announces its entry into the space with a new product that will compete directly with Zoomplanet's flagship product line, which spooks investors

c. Zoomplanet executives are sued for discrimination by an employee group and, due to leadership problems and lack of training programs, the lawsuit has merit

d. Zoomplanet's third-party vendor experienced a data breach, due to insufficient security measures, such that some of Zoomplanet's own customers' information was leaked to the public

700.2. Which of the following is MOST LIKELY to be considered a loss event classified under operational risk?

a. Oil markets unexpectedly pivot and the price of oil adversely impacts an airline's quarterly reported profit

b. Sales drop at a fast casual retail chain because an illness outbreak at a rival (i.e., competitor's) chain damaged the sector's reputation

c. Acme Bank paid the USD currency it sold in the forward contract but did not receive the AUD currency that it bought from the counterparty

d. A company's bitcoin wallet software was installed on its own servers, but a cyber attack crashed the software and private (bitcoin) keys were lost

700.3. Wayne Financial Enterprises is an international bank that trades publicly. Each of the following is an operational risk at Wayne EXCEPT which is probably NOT classified as an operational risk?

a. The new CEO re-engineers the executive organizational structure as part of a five-year strategic plan, but morale plummets and executives depart, resulting a prolonged revenue slump

b. Regulators discover that account managers at retail branches, pressured by sales incentive plans, created over one million checking and saving accounts that customers never authorized

c. The bank's VaR model is re-calibrated, due to inappropriate pressure from line managers, which justifies riskier derivative positions; the riskier positions consequently lead to an unexpected quarterly loss

d. Regulators implicate one of Wayne's major customers in a money laundering scheme in which large cash sums earned by a criminal enterprise have been diverted into Wayne's accounts for the purpose of making them appear to be legitimate funds

Answers here:

Last edited by a moderator: