Learning Objectives: Explain the calculation of risk-weighted assets and the capital requirement per the original Basel I guidelines. Describe measures introduced in the 1995 & 1996 amendments, including guidelines for netting of credit exposures & methods to calculate market risk capital for assets in the trading book. Calculate credit risk capital under Basel II utilizing the IRB approach.

Questions:

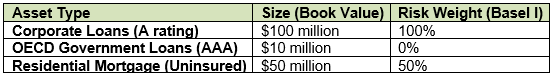

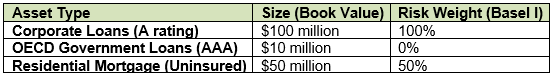

24.10.1. An analyst at Bank DeNiro has been tasked with calculating the Risk-Weighted Assets (RWA) under the Basel I framework and reporting on how they would differ under Basel II. Below are the assets listed on its balance sheet:

Using the provided Basel I risk weights, calculate the total Risk-Weighted Assets (RWA) under Basel I and select the option that correctly compares it to the potential RWA under Basel II.

a. RWA under Basel I is $125 million, whereas under Basel II it would be lower.

b. RWA under Basel I is $67.5 million, whereas under Basel II it would be higher.

c. RWA under Basel I is $135 million, whereas under Basel II it would be lower.

d. RWA under Basel I is $100 million, whereas under Basel II it would be higher.

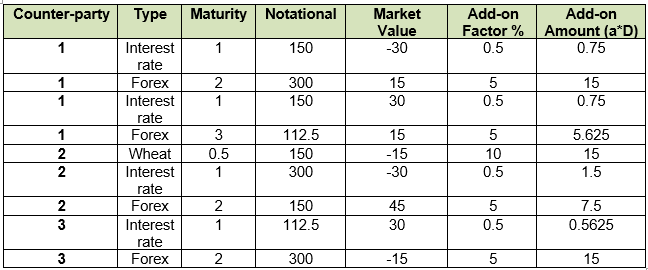

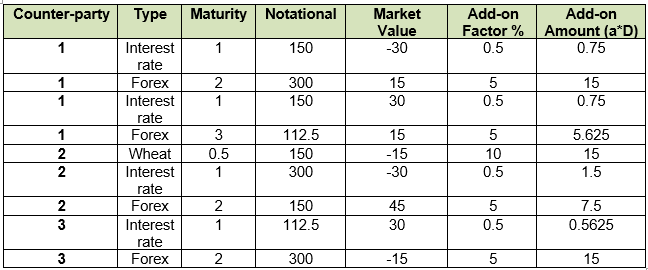

24.10.2. A bank has the following counterparty exposures.

Which of the below statements is most correct?

a. The credit exposure with netting is $5 million; without netting, it is $20; the NRR approximates to 0.25, and the CEA approximates £33.05 million.

b. The credit exposure with netting is $5 million; without netting, it is $20 million; the NRR approximates to 0.25, and the CEA approximates to 28.05

c. The credit exposure with netting is $5 million; without netting, it is $20 million; the NRR approximates to 0.25, and the CEA approximates to $51 million.

d. The credit exposure with netting is $31 million; without netting, it is $51 million; the NRR approximates to 0.25, and the CEA approximates to $33.05 million

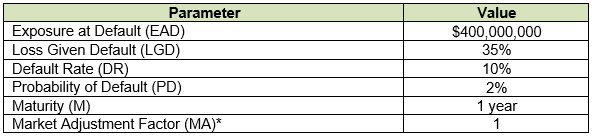

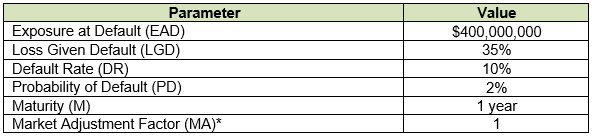

24.10.3. Bank Fortuna is assessing the credit risk capital required for a particular retail loan portfolio under the Basel II IRB approach. The following parameters are given for the loan that has a maturity of 1 year:

* MA = 1 + b(M-2.5)/(1-1.5b). However, under the Internal Ratings-Based (IRB) approach, retail exposures generally do not require a maturity adjustment (MA) because the MA is automatically set to 1.

Calculate the Risk-Weighted Assets (RWA) under the Basel II IRB approach and identify the most accurate estimation.

a. RWA is $140m

b. RWA is $35m,

c. RWA is $400m

d. RWA is $2.8m

Answers here:

Questions:

24.10.1. An analyst at Bank DeNiro has been tasked with calculating the Risk-Weighted Assets (RWA) under the Basel I framework and reporting on how they would differ under Basel II. Below are the assets listed on its balance sheet:

Using the provided Basel I risk weights, calculate the total Risk-Weighted Assets (RWA) under Basel I and select the option that correctly compares it to the potential RWA under Basel II.

a. RWA under Basel I is $125 million, whereas under Basel II it would be lower.

b. RWA under Basel I is $67.5 million, whereas under Basel II it would be higher.

c. RWA under Basel I is $135 million, whereas under Basel II it would be lower.

d. RWA under Basel I is $100 million, whereas under Basel II it would be higher.

24.10.2. A bank has the following counterparty exposures.

Which of the below statements is most correct?

a. The credit exposure with netting is $5 million; without netting, it is $20; the NRR approximates to 0.25, and the CEA approximates £33.05 million.

b. The credit exposure with netting is $5 million; without netting, it is $20 million; the NRR approximates to 0.25, and the CEA approximates to 28.05

c. The credit exposure with netting is $5 million; without netting, it is $20 million; the NRR approximates to 0.25, and the CEA approximates to $51 million.

d. The credit exposure with netting is $31 million; without netting, it is $51 million; the NRR approximates to 0.25, and the CEA approximates to $33.05 million

24.10.3. Bank Fortuna is assessing the credit risk capital required for a particular retail loan portfolio under the Basel II IRB approach. The following parameters are given for the loan that has a maturity of 1 year:

* MA = 1 + b(M-2.5)/(1-1.5b). However, under the Internal Ratings-Based (IRB) approach, retail exposures generally do not require a maturity adjustment (MA) because the MA is automatically set to 1.

Calculate the Risk-Weighted Assets (RWA) under the Basel II IRB approach and identify the most accurate estimation.

a. RWA is $140m

b. RWA is $35m,

c. RWA is $400m

d. RWA is $2.8m

Answers here:

Last edited: