Learning objective: Describe and calculate the following metrics for credit exposure: expected mark-to-market, expected exposure, potential future exposure ....

Questions:

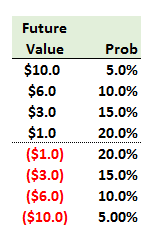

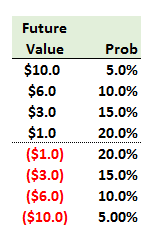

908.1. The probability distribution of the expected future value (EFV) of a position in a derivative contract is illustrated below:

What is the expected exposure (EE) of this position?

a. Zero

b. 1.75

c. 3.50

d. 5.25

908.2. Suppose future value is defined by a normal distribution with mean, µ= $3.0 million, and standard deviation, σ = $5.0 million. Each of the following statements is true EXCEPT which is false?

a. The 99.0% potential future exposure (PFE) is about $14.63 million

b. The expected exposure (EE) must be greater than expected future value (EFV)

c. If volatility increases from σ = $5.0 to σ = $8.0 million, the EE will be unchanged

d. If volatility increases from σ = $5.0 to σ = $8.0 million, the 95% potential future exposure (PFE) will increase

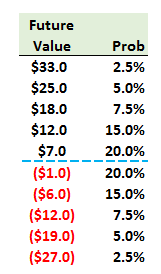

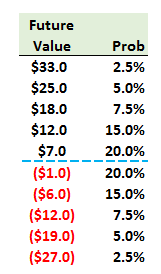

908.3. Below is displayed the probability distribution of the future value (FV) for a position in a derivative contract. The distribution has a mean, µ = $3.0. Its standard deviation, σ = $12.56. Its skew is zero but it is not quite normal as its kurtosis is 2.95.

What is the 95.0% potential future exposure (PFE) of this position?

a. -19.00

b. +13.25

c. +25.00

d. +33.00

Answers here:

Questions:

908.1. The probability distribution of the expected future value (EFV) of a position in a derivative contract is illustrated below:

What is the expected exposure (EE) of this position?

a. Zero

b. 1.75

c. 3.50

d. 5.25

908.2. Suppose future value is defined by a normal distribution with mean, µ= $3.0 million, and standard deviation, σ = $5.0 million. Each of the following statements is true EXCEPT which is false?

a. The 99.0% potential future exposure (PFE) is about $14.63 million

b. The expected exposure (EE) must be greater than expected future value (EFV)

c. If volatility increases from σ = $5.0 to σ = $8.0 million, the EE will be unchanged

d. If volatility increases from σ = $5.0 to σ = $8.0 million, the 95% potential future exposure (PFE) will increase

908.3. Below is displayed the probability distribution of the future value (FV) for a position in a derivative contract. The distribution has a mean, µ = $3.0. Its standard deviation, σ = $12.56. Its skew is zero but it is not quite normal as its kurtosis is 2.95.

What is the 95.0% potential future exposure (PFE) of this position?

a. -19.00

b. +13.25

c. +25.00

d. +33.00

Answers here: