Learning objectives: Define securitization, describe the securitization process and explain the role of participants in the process. Explain the terms over-collateralization, first-loss piece, equity piece, and cash waterfall within the securitization process. Analyze the differences in the mechanics of issuing securitized products using a trust versus a special purpose vehicle (SPV) and distinguish between the three main SPV structures: amortizing, revolving, and master trust.

Questions:

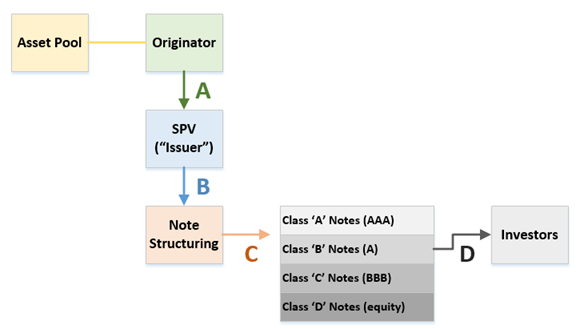

610.1. Consider the securitization process illustrated below, with linkages identified as "A," "B", "C" and "D":

Each of the following is true about the four illustrated linkages above EXCEPT which identifier (A, B, C, or D) is incorrect?

a. "A" is a true sale

b. "B" is proceeds from sale of assets

c. "C" is credit tranching

d. "D" is placing of notes in the capital markets

610.2. If the nominal value of the credit-sensitive assets in the collateral pool are exactly equal to the nominal value of issued securities, then which of the following is equal to zero?

a. First-loss piece

b. Equity piece

c. Excess spread

d. Over-collateralization

610.3. Which of the following structures is most likely to be used by an infrequent issuer of securities whose asset pool consists of credit card debt; i.e., short-dated assets with a relatively high pre-payment speed?

a. Master trust

b. Amortizing structure

c. Revolving structure

d. None of the above

Answers:

Questions:

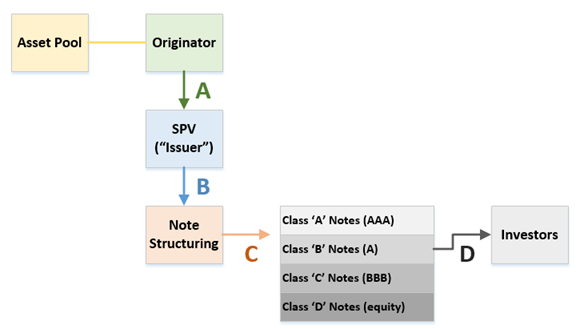

610.1. Consider the securitization process illustrated below, with linkages identified as "A," "B", "C" and "D":

Each of the following is true about the four illustrated linkages above EXCEPT which identifier (A, B, C, or D) is incorrect?

a. "A" is a true sale

b. "B" is proceeds from sale of assets

c. "C" is credit tranching

d. "D" is placing of notes in the capital markets

610.2. If the nominal value of the credit-sensitive assets in the collateral pool are exactly equal to the nominal value of issued securities, then which of the following is equal to zero?

a. First-loss piece

b. Equity piece

c. Excess spread

d. Over-collateralization

610.3. Which of the following structures is most likely to be used by an infrequent issuer of securities whose asset pool consists of credit card debt; i.e., short-dated assets with a relatively high pre-payment speed?

a. Master trust

b. Amortizing structure

c. Revolving structure

d. None of the above

Answers: