H

Thanks

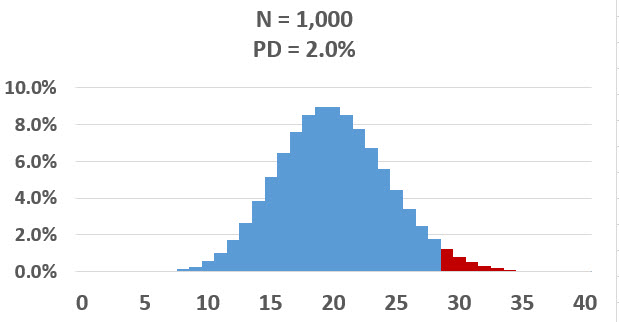

Hi, how do we do this in case of 2 bonds with default correlation of 30% and joint default probability of 1.5%Hi @Kavita.bhangdia You are right about 98.32% but let's list them out. To re-cap, for question 309.3, N = 20, pd = 0.01, and we are assuming independence which justifies the binomial:

If we want the 95.0% VaR, we only go 95.0% "into the tail:" 0 defaults only gets us to 81.79% so we go to the "next worse" outcome which is 98.31%. We've gone far enough, the 95.0% quantile is one default. In fact, the 98.0% VaR is still one default; and so is the 99.0% VaR still one default, because 98.0% < 99.90% and 99.0% < 99.90%. The precise Prob[2 defaults or less] = 99.8996%, so the 99.9% VaR here is two (2) defaults, barely

- Prob(exactly 0 defaults) = 0.99^20 = 81.79%

- Prob(exactly 1 default) = 0.99^19*.01*20 = 16.52%, so the cumulative Prob[1 default or less] = Prob[0 or 1 default] = 81.79%+16.52%=98.31%

- Prob(exactly 2 defaults) = 0.99^18*01^2*190= 1.59%, so the cumulative Prob[2 defaults or less] = Prob[0 or 1 or 2] = 98.31% + 1.59% = 99.90%

I hope that helps!

Thanks