Fran

Administrator

AIMs: Define the different ways of representing spreads. Compare and differentiate between the different spread conventions and compute one spread given others when possible. Define and compute the Spread ‘01.

Questions:

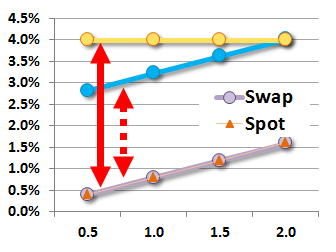

306.1. The following curves are applicable to a risky 2-year bond that pays 6.0% semi-annual coupon:

The bond's market price of $103.73 can be computed by discounting its cash flows continuously at 4.0% per annum, which is represented by the flat yellow line. Specifically: $3.00*exp(-4%*0.5) + $3.00*exp(-4%*1.0) + $3.00*exp(-4%*1.5) + $103.00*exp(-4%*2.0) = $103.73. The bond's same market price of $104.73 can also be derived by discounting the same cash flows according to the continuous discount rates given by the the steep blue line. The lower steep line, which shows a rate of 0.40% at six months, is actually two nearby curves: a swap rate curve and nearby spot rate curve. Both start at 0.40% but, as the spot rate curve is slightly steeper, by year 2.0, the spot rate is 1.61% while the swap rate is 1.60%. For this purpose, we assume both the spot and are risk-free curves; e.g., US Treasury.

Each of the following is true about this bond EXCEPT which is false?

a. The bond's yield-to-maturity is 4.0%

b. The yield spread, represented by the solid red vertical arrow, is the difference between 4.0% (yellow line) and 0.40% (spot rate at six months)

c. If the price of the bond decreased due solely to perceived credit risk of bond (without any change in market risk), the upper curves (yellow and blue) would shift up

d. The z-spread, represented by the dashed red vertical arrow, is the difference between the (upper steep) blue line and the (lower steep) spot rate; e.g., 2.42% = 4.03% - 1.61%

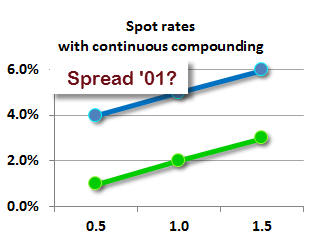

306.2. The risk-free spot rate curve is (unrealistically) steep and given by the following: 1.0% at 0.5 years, 2.0% at 1.0 year, and 3.0% at 1.5 years, with continuously compounded rates (this question being sourced in Malz). (Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

A 1.5 year bond that pays a 10.0% semi-annual coupon has a price of $105.62 such that its z-spread happens be a round 3.00%. Specifically, $105.62 = $5.00*exp[-(1.0%+3.0%)*0.5] + $5.00*exp[-(2.0%+3.0%)*1.0] + $105.00*exp[-(3.0%+3.0%)*1.5].

Which is nearest to the bond's Spread '01 (aka, DVCS) per $1,000,000 of par value?

a. $0.14

b. $36.09

c. $151.16

d. $2,836.24

306.3. In regard to Malz's credit spreads, each of the following is accurate EXCEPT which is false?

a. A risky bond has a different z-spread at each coupon date; e.g., a semi-annual coupon bond with five years to maturity has 10 different z-spreads

b. The z-spread is the spread that must be added to the risk-free spot rate curve in order to arrive at the market price of the bond

c. The i- (or interpolated) spread is the difference between the bond's risky yield (YTM) and the linearly interpolated yield between the two swap rates with maturities flanking that of the risky bond

d. The spread '01 (DVCS) is generally a decreasing function of the z-spread level

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Answers:

Questions:

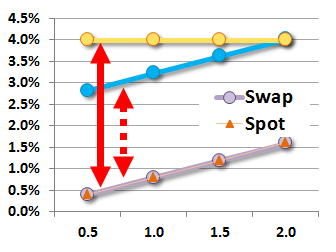

306.1. The following curves are applicable to a risky 2-year bond that pays 6.0% semi-annual coupon:

The bond's market price of $103.73 can be computed by discounting its cash flows continuously at 4.0% per annum, which is represented by the flat yellow line. Specifically: $3.00*exp(-4%*0.5) + $3.00*exp(-4%*1.0) + $3.00*exp(-4%*1.5) + $103.00*exp(-4%*2.0) = $103.73. The bond's same market price of $104.73 can also be derived by discounting the same cash flows according to the continuous discount rates given by the the steep blue line. The lower steep line, which shows a rate of 0.40% at six months, is actually two nearby curves: a swap rate curve and nearby spot rate curve. Both start at 0.40% but, as the spot rate curve is slightly steeper, by year 2.0, the spot rate is 1.61% while the swap rate is 1.60%. For this purpose, we assume both the spot and are risk-free curves; e.g., US Treasury.

Each of the following is true about this bond EXCEPT which is false?

a. The bond's yield-to-maturity is 4.0%

b. The yield spread, represented by the solid red vertical arrow, is the difference between 4.0% (yellow line) and 0.40% (spot rate at six months)

c. If the price of the bond decreased due solely to perceived credit risk of bond (without any change in market risk), the upper curves (yellow and blue) would shift up

d. The z-spread, represented by the dashed red vertical arrow, is the difference between the (upper steep) blue line and the (lower steep) spot rate; e.g., 2.42% = 4.03% - 1.61%

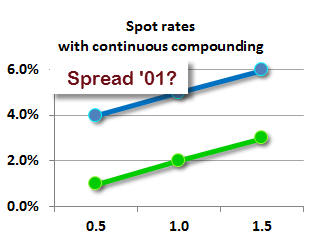

306.2. The risk-free spot rate curve is (unrealistically) steep and given by the following: 1.0% at 0.5 years, 2.0% at 1.0 year, and 3.0% at 1.5 years, with continuously compounded rates (this question being sourced in Malz). (Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

A 1.5 year bond that pays a 10.0% semi-annual coupon has a price of $105.62 such that its z-spread happens be a round 3.00%. Specifically, $105.62 = $5.00*exp[-(1.0%+3.0%)*0.5] + $5.00*exp[-(2.0%+3.0%)*1.0] + $105.00*exp[-(3.0%+3.0%)*1.5].

Which is nearest to the bond's Spread '01 (aka, DVCS) per $1,000,000 of par value?

a. $0.14

b. $36.09

c. $151.16

d. $2,836.24

306.3. In regard to Malz's credit spreads, each of the following is accurate EXCEPT which is false?

a. A risky bond has a different z-spread at each coupon date; e.g., a semi-annual coupon bond with five years to maturity has 10 different z-spreads

b. The z-spread is the spread that must be added to the risk-free spot rate curve in order to arrive at the market price of the bond

c. The i- (or interpolated) spread is the difference between the bond's risky yield (YTM) and the linearly interpolated yield between the two swap rates with maturities flanking that of the risky bond

d. The spread '01 (DVCS) is generally a decreasing function of the z-spread level

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Answers: