Learning Objectives: Apply the Merton model to calculate default probability and the distance to default and describe the limitations of using the Merton model. Merton model Compare and contrast different approaches to credit risk modeling, such as those related to the, Credit Risk Plus (CreditRisk+), CreditMetrics, and the Moody’s-KMV model. Apply risk-adjusted return on capital (RAROC) to measure the performance of a loan.

Questions:

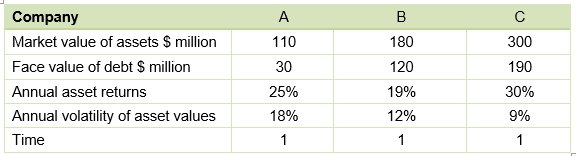

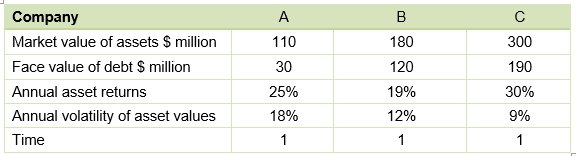

24.7.1. A credit manager in the counterparty risk division of a large bank uses a simplified version of the Merton model to monitor the relative vulnerability of its largest counterparties to changes in their valuation and financial conditions. To assess the risk of default of three particular counterparties, the manager calculates the distance to default, assuming a 1-year horizon (t=1). The counterparties are Company A, Company B, and Company C.

All three firms belong to the same industry and are non-dividend. Selected information on the companies is provided in the table below:

Using the information above with the assumption that a zero-coupon bond maturing in 1 year is the only liability for each company, and using the approximation formula of the distance to default, what is the correct ranking of the counterparties, from least likely to default to most likely?

a. A, C, B

b. B, A, C

c. B, C, A

d. C, B, A

24.7.2. Sam is tasked with evaluating the firm's exposure to credit risk arising from its extensive portfolio, which includes corporate bonds, loans, and structured credit products. The firm seeks to refine its risk management strategy by selecting a credit risk model that offers dynamic adaptability to market conditions, accurate default probability estimation, and considers the firm's specific portfolio characteristics.

Sam reviews four key credit risk models: the Merton model, CreditRisk+, CreditMetrics, and the Moody’s-KMV model. Each model presents unique features and assumptions:

Considering the need for dynamic adaptability, accurate default probability estimation, and suitability for a diversified financial portfolio, which credit risk model should Sam recommend for the firm’s risk management strategy?

a. Merton Model

b. Credit Risk+

c. CreditMetrics

d. Moody’s-KMV model

24.7.3. A commercial bank is evaluating the potential financial impact of extending a 1-year loan of EUR 420 million. The terms and associated costs of this loan are as follows:

a. 42%

b. 21%

c. 18%

d. 1%

Answers here:

Questions:

24.7.1. A credit manager in the counterparty risk division of a large bank uses a simplified version of the Merton model to monitor the relative vulnerability of its largest counterparties to changes in their valuation and financial conditions. To assess the risk of default of three particular counterparties, the manager calculates the distance to default, assuming a 1-year horizon (t=1). The counterparties are Company A, Company B, and Company C.

All three firms belong to the same industry and are non-dividend. Selected information on the companies is provided in the table below:

Using the information above with the assumption that a zero-coupon bond maturing in 1 year is the only liability for each company, and using the approximation formula of the distance to default, what is the correct ranking of the counterparties, from least likely to default to most likely?

a. A, C, B

b. B, A, C

c. B, C, A

d. C, B, A

24.7.2. Sam is tasked with evaluating the firm's exposure to credit risk arising from its extensive portfolio, which includes corporate bonds, loans, and structured credit products. The firm seeks to refine its risk management strategy by selecting a credit risk model that offers dynamic adaptability to market conditions, accurate default probability estimation, and considers the firm's specific portfolio characteristics.

Sam reviews four key credit risk models: the Merton model, CreditRisk+, CreditMetrics, and the Moody’s-KMV model. Each model presents unique features and assumptions:

- The Merton model utilizes the firm's equity volatility to estimate the probability of default, treating the firm's capital structure as a call option on its assets.

- CreditRisk+ is an actuarial model focusing on the probability of default based on debt rating and sensitivity to risk factors, employing a Poisson distribution to model credit events such as bankruptcy.

- CreditMetrics employs a mark-to-market approach, emphasizing credit rating transitions and the valuation impact of credit events on the portfolio, using a comprehensive set of market data.

- The Moody’s-KMV model, an evolution of the Merton model, utilizes market data to estimate default probabilities with its Expected Default Frequency (EDF) model, providing continuous updates based on market conditions.

Considering the need for dynamic adaptability, accurate default probability estimation, and suitability for a diversified financial portfolio, which credit risk model should Sam recommend for the firm’s risk management strategy?

a. Merton Model

b. Credit Risk+

c. CreditMetrics

d. Moody’s-KMV model

24.7.3. A commercial bank is evaluating the potential financial impact of extending a 1-year loan of EUR 420 million. The terms and associated costs of this loan are as follows:

- The loan will accrue interest at a rate of 6% per annum.

- The bank's cost of funding, i.e., the interest paid on deposits, is 0.5% per annum.

- The bank anticipates an expected loss, due to non-payment or other factors, equivalent to 3% of the loan's face value.

- Operational costs for managing the loan are projected to be 1% of its face value.

- The economic capital, which is the reserve the bank must hold against the loan as a risk mitigation measure, is set at 5% of the loan amount.

- The return on this economic capital before taxes is expected to be 2%.

- The bank operates under a tax rate of 35%.

- Transaction costs EUR 1m

a. 42%

b. 21%

c. 18%

d. 1%

Answers here:

Last edited: