Fran

Administrator

AIMs: Describe the short-term rate process under the Cox-Ingersoll-Ross (CIR) and Lognormal models. Calculate the short-term rate change and describe the basis point volatility using the CIR and Lognormal models. Summarize the application of a lognormal model with deterministic drift and a lognormal model with mean reversion

Questions:

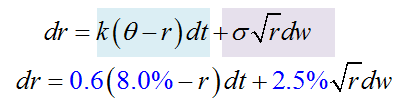

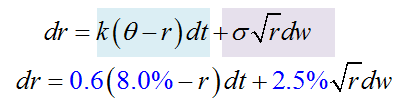

307.1. Donald the analyst is employing the Cox-Ingersoll-Ross (CIR) model for the short-term rate process:

(Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

His assumptions include (see above):

a. -0.250%

b. 0.444%

c. 1.390%

d. 2.172%

307.2. Peter the analyst is constructing a binomial tree according to Tuckman's lognormal model (without mean reversion). Here are his assumptions and partial tree (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)):

His assumptions include:

a. 1.98665%

b. 2.05350%

c. 2.38794%

d. 3.12550%

307.3. Each of the following is true about lognormal models of the short-term interest rate process EXCEPT for:

a. In the lognormal models, the the natural logarithm of the short rate is normally distributed

b. Like the Cox-Ingersoll-Ross (CIR), the lognormal models offer the advantage of not allowing negative rates

c. The lognormal model without mean reversion is similar to the Ho-Lee model but based on the natural logarithm of the short rate instead of on the short rate itself

d. The Black-Karasinski Model is similar to the Ho-Lee Model but instead is an equilibrium model with constant drift

Answers:

Questions:

307.1. Donald the analyst is employing the Cox-Ingersoll-Ross (CIR) model for the short-term rate process:

(Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

His assumptions include (see above):

- The time-step is monthly, dt = 1/12

- Today's initial rate, r(0) = 1.00%

- The annual basis point volatility, sigma = 2.50%

- The long-run rate, theta = 8.00%

- The strength of reversion, k = 0.60

a. -0.250%

b. 0.444%

c. 1.390%

d. 2.172%

307.2. Peter the analyst is constructing a binomial tree according to Tuckman's lognormal model (without mean reversion). Here are his assumptions and partial tree (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)):

His assumptions include:

- The time-step is monthly, dt = 1/12

- Today's initial rate, r(0) = 2.00%

- Annual drift is constant at 50 basis points

- The annual basis point volatility, sigma = 9.00%

a. 1.98665%

b. 2.05350%

c. 2.38794%

d. 3.12550%

307.3. Each of the following is true about lognormal models of the short-term interest rate process EXCEPT for:

a. In the lognormal models, the the natural logarithm of the short rate is normally distributed

b. Like the Cox-Ingersoll-Ross (CIR), the lognormal models offer the advantage of not allowing negative rates

c. The lognormal model without mean reversion is similar to the Ho-Lee model but based on the natural logarithm of the short rate instead of on the short rate itself

d. The Black-Karasinski Model is similar to the Ho-Lee Model but instead is an equilibrium model with constant drift

Answers: