Fran

Administrator

AIMs: Describe the short-term rate process under a model with time-dependent volatility (Model 3). Calculate the short-term rate change and describe the behavior of the standard deviation of the change of the rate using a model with time dependent volatility. Describe the effectiveness of time-dependent volatility models.

Questions:

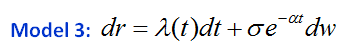

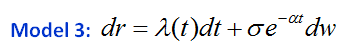

306.1. Becky the Analyst wants to apply Tuckman's Model 3 for short-term interest rates. Model 3 captures time-dependent volatility and its process is given by:

(Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

She makes the following assumptions:

Which is nearest to the change in the rate, dr, given by Becky's model for the 60th month, dr(5.0)?

a. -1.00%

b. 0.00%

c. +1.00%

d. +2.00%

306.2. Peter wants to utilize Model 3 with time-dependent volatility. His colleague Mary prefers the Vasicek Model in the current environment. Mary makes the following two arguments in favor of the Vasicek Model over Model 3 (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)) :

Which of Mary's argument(s) are good, according to Tuckman?

a. Neither, Mary might consider sitting for the FRM

b. I. only

c. II. only

d. Both, Mary must be a Certified FRM!

306.3. Consider the following five-part summary of the interest rate Models in Tuckman (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)) :

Which of the above are true?

a. None

b. I. and II. only

c. III. and V. only

d. All are true

Answers:

Questions:

306.1. Becky the Analyst wants to apply Tuckman's Model 3 for short-term interest rates. Model 3 captures time-dependent volatility and its process is given by:

(Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

She makes the following assumptions:

- The time step is monthly, dt = 1/12

- The initial short-term rate, r(0) = 4.00%

- The annual basis point volatility = 3.00%

- The annual drift, lambda(t), is constant at 130 basis points (+1.30%) per year

- The alpha parameter = 0.380

Which is nearest to the change in the rate, dr, given by Becky's model for the 60th month, dr(5.0)?

a. -1.00%

b. 0.00%

c. +1.00%

d. +2.00%

306.2. Peter wants to utilize Model 3 with time-dependent volatility. His colleague Mary prefers the Vasicek Model in the current environment. Mary makes the following two arguments in favor of the Vasicek Model over Model 3 (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)) :

I. "Unlike the economic intuitions that attach to mean reversion in Vasicek, Model 3's time-dependent volatility relies on the difficult argument that the market has a forecast of short-term volatility in the distant future."

II. "The downward-sloping factor structure and term structure of volatility in mean-reverting models capture the behavior of interest rate movements better than parallel shifts and a flat term structure of volatility."

Which of Mary's argument(s) are good, according to Tuckman?

a. Neither, Mary might consider sitting for the FRM

b. I. only

c. II. only

d. Both, Mary must be a Certified FRM!

306.3. Consider the following five-part summary of the interest rate Models in Tuckman (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)) :

I. Model 1 is a simple equilibrium model with normally distributed (random) rates but without drift (no drift)

II. Model 2 adds a constant drift (a.k.a., risk premium) to Model 1 such that Model 2 includes constant drift plus a normally distributed (random) rate; but is also an equilibrium model

III. The Ho-Lee Model, similar Models 1 and 2 has a normally distributed (random) rate, but unlike them has time-dependent drift and can thusly be considered an arbitrage-free model

IV. The Vasicek Model assumes a normally distributed (random) interest rate but assumes the rate is characterized by mean reversion toward a long-run value (central tendency)

V. Unlike the previous Models (Models 1 and 2; Ho-Lee; Vasicek) which assume normally distributed rates, Model 3 introduces time-dependent volatility

Which of the above are true?

a. None

b. I. and II. only

c. III. and V. only

d. All are true

Answers: