Fran

Administrator

AIMs: Describe the process of and construct a simple and recombining tree for a short-term rate under the Vasicek Model with mean reversion. Calculate the Vasicek Model rate change, standard deviation of the change of the rate, expected rate in T years, and half life. Describe the effectiveness of the Vasicek Model.

Questions:

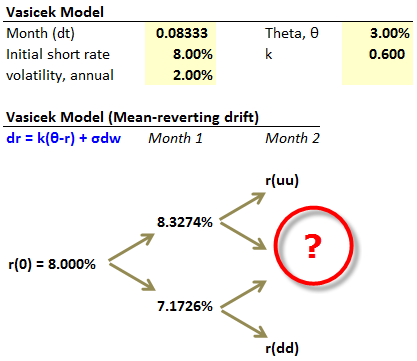

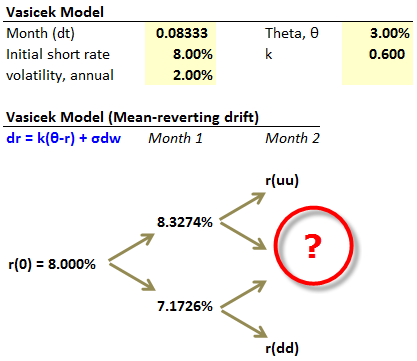

305.1. Analyst Steven is building a short-term interest rate tree according to the Vasicek Model which is characterized by mean reversion, and where the time step is monthly (dt = 1/12). The current short-term rate, r(0) is 8.00%. The annual basis point volatility is 200 basis points. Theta is the long-run value (or central tendency) of the short-term rate; in Steven's model theta is 3.00%. Finally, the constant (k) which denotes the speed of mean reversion is equal to 0.60. In brief, Steven's Vasicek model is given by dr = 0.60*(3.0% - r)*dt + sigma*dw.

What is the value in the Vasicek tree at node [2,1]?

a. 6.833%

b. 7.513%

c. 8.019%

d. 9.225%

305.2. Analyst Susan is employing the Vasicek Model which is characterized by mean reversion and described by the following process:

The current short-term rate, r(0), is equal to 2.00%. Susan's assumptions include:

a. r(1/12) = 2.0860% and half-life is ~ 1.7 years

b. r(1/12) = 3.1920% and half-life is ~ 2.5 years

c. r(1/12) = 4.3333% and half-life is ~ 7.4 years

d. r(1/12) = 5.2136% and half-life is ~ 15.5 years

305.3. Each of the following statements is true about the Vasicek Model EXCEPT:

a. The Vasicek Model, like the Ho-Lee model, is an arbitrage-free model

b. In the Vasicek Model, half-life is given by LN(2)/k and can be interpreted as the time it takes for the short-rate (the factor) to progress half the distance toward the long-run value (Theta)

c. The mean reversion in Vasicek dampens volatility relative to the same process without mean reversion, particularly at long horizons

d. Due to the mean-reversion, it is impossible to develop a rate tree that recombines under Vasicek

Answers:

Questions:

305.1. Analyst Steven is building a short-term interest rate tree according to the Vasicek Model which is characterized by mean reversion, and where the time step is monthly (dt = 1/12). The current short-term rate, r(0) is 8.00%. The annual basis point volatility is 200 basis points. Theta is the long-run value (or central tendency) of the short-term rate; in Steven's model theta is 3.00%. Finally, the constant (k) which denotes the speed of mean reversion is equal to 0.60. In brief, Steven's Vasicek model is given by dr = 0.60*(3.0% - r)*dt + sigma*dw.

What is the value in the Vasicek tree at node [2,1]?

a. 6.833%

b. 7.513%

c. 8.019%

d. 9.225%

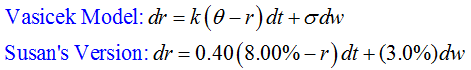

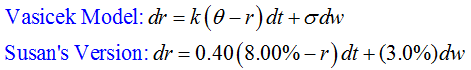

305.2. Analyst Susan is employing the Vasicek Model which is characterized by mean reversion and described by the following process:

The current short-term rate, r(0), is equal to 2.00%. Susan's assumptions include:

- Time step is one month: dt = 1/12

- The long-run value (or central tendency), theta = 8.00%

- The speed of mean reversion, k = 0.40

- Annual basis point volatility = 300 basis points

a. r(1/12) = 2.0860% and half-life is ~ 1.7 years

b. r(1/12) = 3.1920% and half-life is ~ 2.5 years

c. r(1/12) = 4.3333% and half-life is ~ 7.4 years

d. r(1/12) = 5.2136% and half-life is ~ 15.5 years

305.3. Each of the following statements is true about the Vasicek Model EXCEPT:

a. The Vasicek Model, like the Ho-Lee model, is an arbitrage-free model

b. In the Vasicek Model, half-life is given by LN(2)/k and can be interpreted as the time it takes for the short-rate (the factor) to progress half the distance toward the long-run value (Theta)

c. The mean reversion in Vasicek dampens volatility relative to the same process without mean reversion, particularly at long horizons

d. Due to the mean-reversion, it is impossible to develop a rate tree that recombines under Vasicek

Answers: