question:

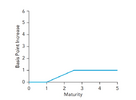

Suppose that the 12-month and 30-month spot rates are chosen as key rates. Plot the key rate 01 shifts.

why is the 12-month shift plotted so that the shift starts from maturity 0 and then starts the decline from maturity 1 (12 months) onwards whereas the plotting the 30.month spot rate shift starts increasing at 1 (12-month maturity) and doesn't decline after 2,5 maturity (30 months)?

How would 24 month spot rate be 01 shifted?

Answer:

Suppose that the 12-month and 30-month spot rates are chosen as key rates. Plot the key rate 01 shifts.

why is the 12-month shift plotted so that the shift starts from maturity 0 and then starts the decline from maturity 1 (12 months) onwards whereas the plotting the 30.month spot rate shift starts increasing at 1 (12-month maturity) and doesn't decline after 2,5 maturity (30 months)?

How would 24 month spot rate be 01 shifted?

Answer:

Last edited: