You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

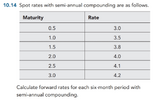

P1.T4 "Valuation & Risk Model" EOC 10.14.

- Thread starter AUola2165

- Start date

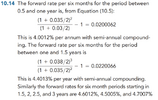

Hi @AUola2165 I get their answer, because (1 + z_1.0/2)^2*(1 + f/2) = (1 + z_1.5/2)^3:

(1 + f/2) = (1 + z_1.5/2)^3 / (1 + z_1.0/2)^2,

f/2 = (1 + z_1.5/2)^3 / (1 + z_1.0/2)^2 - 1,

f = [(1 + z_1.5/2)^3 / (1 + z_1.0/2)^2 - 1] * 2; i.e.,

f = [(1 + 3.80%/2)^3 / (1 + 3.50%/2)^2 - 1] * 2 = 2.20066% * 2 = 4.40133% = f(1.0, 1.5).

... nit: it's awkward to write "the forward rate per six months ...". Thanks,

(1 + f/2) = (1 + z_1.5/2)^3 / (1 + z_1.0/2)^2,

f/2 = (1 + z_1.5/2)^3 / (1 + z_1.0/2)^2 - 1,

f = [(1 + z_1.5/2)^3 / (1 + z_1.0/2)^2 - 1] * 2; i.e.,

f = [(1 + 3.80%/2)^3 / (1 + 3.50%/2)^2 - 1] * 2 = 2.20066% * 2 = 4.40133% = f(1.0, 1.5).

... nit: it's awkward to write "the forward rate per six months ...". Thanks,

Similar threads

- Replies

- 1

- Views

- 581

- Replies

- 0

- Views

- 239

- Replies

- 0

- Views

- 220

- Replies

- 1

- Views

- 292