Roberto Hernández

Member

Hi Team,

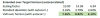

I hope you're having a great day. I was wondering if you could help me understand the below idea, on page 8 of reading 25, there's a table in which it is calculated the parametric VaR for a 1D horizon and then extended to a 10D horizon using the square root rule.

My question is, from the below table and taking into account the autocorrelation as 0, 0.2 and -0.2 respectively how those 3 rows were computed?

I believe this is not a tested concept, but I would like to understand.

Thanks a lot.

-Roberto

I hope you're having a great day. I was wondering if you could help me understand the below idea, on page 8 of reading 25, there's a table in which it is calculated the parametric VaR for a 1D horizon and then extended to a 10D horizon using the square root rule.

My question is, from the below table and taking into account the autocorrelation as 0, 0.2 and -0.2 respectively how those 3 rows were computed?

I believe this is not a tested concept, but I would like to understand.

Thanks a lot.

-Roberto

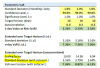

Here is the XLS in case you want to experiment with autocorrelated volatility/VaR

Here is the XLS in case you want to experiment with autocorrelated volatility/VaR