Fran

Administrator

AIMs: Calculate and describe the impact of different compounding frequencies on a bond’s value. Calculate discount factors given interest rate swap rates. Compute spot rates given discount factors.

Questions:

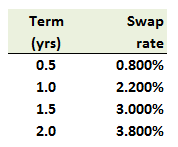

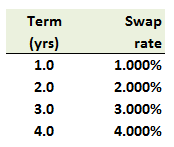

312.1. Assume we observe the following (unrealistically) steep swap rate curve:

This swap rate curve implies semi-annual discount factors and spot rates. Which is nearest to the the implied 1.5 year effective annual spot rate; i.e., the 1.5 year semi-annual spot rate implied by the swap rate curve translated into an effective annual rate (EAR, aka, effective annual yield)?

a. 2.925%

b. 3.000%

c. 3.019%

d. 3.042%

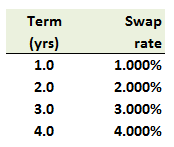

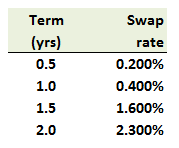

312.2. Incredibly, we observe an annual swap rate curve that is perfectly linear (and quite steep!):

Which are nearest, respectively, to the implied four (4.0) year discount factor and spot rate, if we assume annual compound periods?

a. 0.6030 and 4.0020%

b. 0.8513 and 4.1056%

c. 0.9013 and 3.9450%

d. 0.7546 and 3.2601%

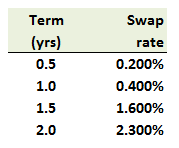

312.3. Assume today we observe the following swap rates:

We can extract discount factors and spot rates from this swap rate curve. If $100,000 is invested today for 1.5 years at the implied 1.5 year spot rate, compounded semi-annually, to which nearest value will the investment grow?

a. $101,758.03

b. $102,419.25

c. $102,434.87

d. $103,240.83

Answers:

Questions:

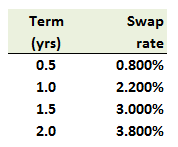

312.1. Assume we observe the following (unrealistically) steep swap rate curve:

This swap rate curve implies semi-annual discount factors and spot rates. Which is nearest to the the implied 1.5 year effective annual spot rate; i.e., the 1.5 year semi-annual spot rate implied by the swap rate curve translated into an effective annual rate (EAR, aka, effective annual yield)?

a. 2.925%

b. 3.000%

c. 3.019%

d. 3.042%

312.2. Incredibly, we observe an annual swap rate curve that is perfectly linear (and quite steep!):

Which are nearest, respectively, to the implied four (4.0) year discount factor and spot rate, if we assume annual compound periods?

a. 0.6030 and 4.0020%

b. 0.8513 and 4.1056%

c. 0.9013 and 3.9450%

d. 0.7546 and 3.2601%

312.3. Assume today we observe the following swap rates:

We can extract discount factors and spot rates from this swap rate curve. If $100,000 is invested today for 1.5 years at the implied 1.5 year spot rate, compounded semi-annually, to which nearest value will the investment grow?

a. $101,758.03

b. $102,419.25

c. $102,434.87

d. $103,240.83

Answers: