Learning Objectives: Compute the value of a European option using the Black-Scholes-Merton model on a dividend-paying stock, futures, and exchange rates. Describe warrants, calculate the value of a warrant, and calculate the dilution cost of the warrant to existing shareholders.

Questions:

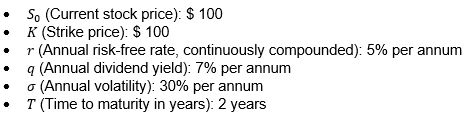

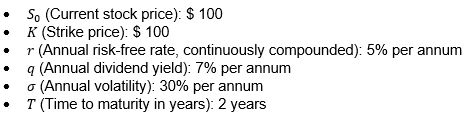

24.18.1. As an analyst in a professional valuer firm, you have been asked to calculate the price of employee stock options assuming they are exercised only at the expiry. You have the following information:

What is the correct value of a European call option?

a. $13.19

b. $16.74

c. $21.19

d. $11.68

24.18.2. A company with 1,000,000 existing shares is considering issuing 100,000 warrants, where each warrant gives the holder the right to buy one new share at a strike price of £50. The current market price of the stock is £55. Assuming markets are efficient and reflect the potential dilution from the outstanding warrants, what is closest to the cost of each warrant to existing shareholders?

a. £5.00

b. £4.50

c. £4.55

d. £5.50

24.18.3. A company currently has 2,000,000 shares outstanding and is considering issuing 200,000 warrants. Each warrant allows the holder to purchase one share at a strike price of USD 25. The current market price of the stock is USD 30. Assume the risk-free rate is 3% per annum, the volatility of the stock is 20% per annum, and the warrants have a maturity of 3 years. Calculate the value of one warrant using the Black-Scholes model modified for warrants and calculate the dilution cost of one warrant to existing shareholders.

a. Warrant Value: USD 8.25, Dilution Cost: USD 7.51

b. Warrant Value: USD 7.50, Dilution Cost: USD 8.25

c. Warrant Value: USD 8.00, Dilution Cost: USD 7.00

d. Warrant Value: USD 9.00, Dilution Cost: USD 8.00

Answers here:

Questions:

24.18.1. As an analyst in a professional valuer firm, you have been asked to calculate the price of employee stock options assuming they are exercised only at the expiry. You have the following information:

What is the correct value of a European call option?

a. $13.19

b. $16.74

c. $21.19

d. $11.68

24.18.2. A company with 1,000,000 existing shares is considering issuing 100,000 warrants, where each warrant gives the holder the right to buy one new share at a strike price of £50. The current market price of the stock is £55. Assuming markets are efficient and reflect the potential dilution from the outstanding warrants, what is closest to the cost of each warrant to existing shareholders?

a. £5.00

b. £4.50

c. £4.55

d. £5.50

24.18.3. A company currently has 2,000,000 shares outstanding and is considering issuing 200,000 warrants. Each warrant allows the holder to purchase one share at a strike price of USD 25. The current market price of the stock is USD 30. Assume the risk-free rate is 3% per annum, the volatility of the stock is 20% per annum, and the warrants have a maturity of 3 years. Calculate the value of one warrant using the Black-Scholes model modified for warrants and calculate the dilution cost of one warrant to existing shareholders.

a. Warrant Value: USD 8.25, Dilution Cost: USD 7.51

b. Warrant Value: USD 7.50, Dilution Cost: USD 8.25

c. Warrant Value: USD 8.00, Dilution Cost: USD 7.00

d. Warrant Value: USD 9.00, Dilution Cost: USD 8.00

Answers here: