AIMs: Describe what a rating scale is ... credit migration (transition) matrix [not in 2012 AIMs, but added as GARP consistently queries in sample papers]

Questions:

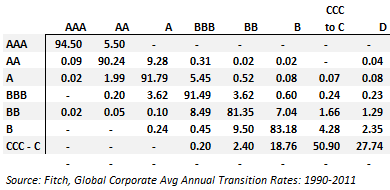

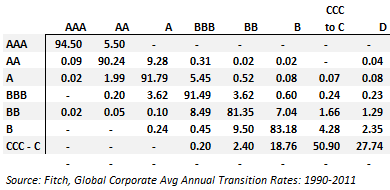

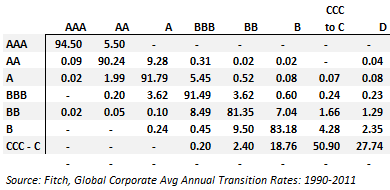

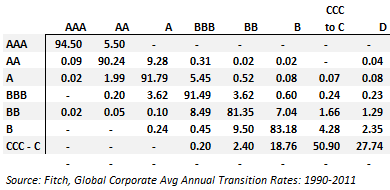

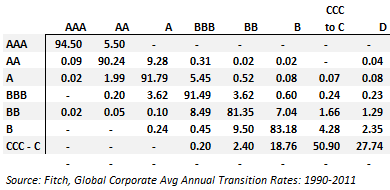

20.1. The following actual, recent rating transition (aka, migration) matrix gives the transition probabilities of corporate bonds for one-year period.

Under an assumption of independence ("Markovian assumption"), what is the unconditional probability that a AAA-rated bond will be exactly AA-rated (one grade lower) at the end of three years?

a. 4.69%

b. 5.50%

c. 9.60%

d. 14.09%

20.2. This migration matrix gives the credit ratings transition probabilities of corporate bonds over a one-year period (same as prior: Fitch's actual updated matrix):

Over the next single year, which of the statements is TRUE?

a. BB obligors have a 9.99% probability of defaulting over the year

b. BB obligors have a 7.04% probability of being downgraded over the year

c. BB obligors have a ~ 90.0% probability of at least maintaining their rating; i.e., ending the year BB or higher

d. It is impossible for a BB obligor to be upgraded to AAA in one year

20.3. Assume the following corporate bond credit rating migration matrix for a one-year period (same as prior: Fitch's actual updated matrix):

What is the cumulative probability that a BB obligor will default within the next two years, assuming Markovian independence?

a. 0.017%

b. 1.290%

c. 2.563%

d. 2.985%

Answers:

Questions:

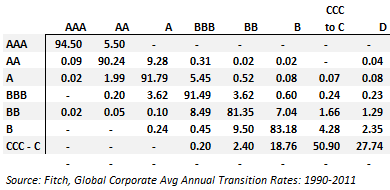

20.1. The following actual, recent rating transition (aka, migration) matrix gives the transition probabilities of corporate bonds for one-year period.

Under an assumption of independence ("Markovian assumption"), what is the unconditional probability that a AAA-rated bond will be exactly AA-rated (one grade lower) at the end of three years?

a. 4.69%

b. 5.50%

c. 9.60%

d. 14.09%

20.2. This migration matrix gives the credit ratings transition probabilities of corporate bonds over a one-year period (same as prior: Fitch's actual updated matrix):

Over the next single year, which of the statements is TRUE?

a. BB obligors have a 9.99% probability of defaulting over the year

b. BB obligors have a 7.04% probability of being downgraded over the year

c. BB obligors have a ~ 90.0% probability of at least maintaining their rating; i.e., ending the year BB or higher

d. It is impossible for a BB obligor to be upgraded to AAA in one year

20.3. Assume the following corporate bond credit rating migration matrix for a one-year period (same as prior: Fitch's actual updated matrix):

What is the cumulative probability that a BB obligor will default within the next two years, assuming Markovian independence?

a. 0.017%

b. 1.290%

c. 2.563%

d. 2.985%

Answers: