Learning objectives: Identify the major risks faced by a bank. Distinguish between economic capital and regulatory capital.

Questions:

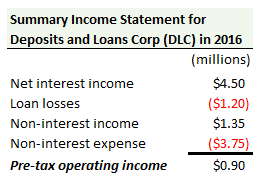

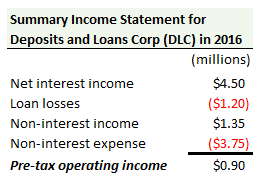

700.1. Below is a hypothetical summary income statement for Deposits and Loans Corporation (DLC):

Risks can affect any line in the income statement, but according to Hull, each major risk category tends to be primarily associated with certain activities as they manifest on the financial statements. In regard to this association between a major risk type and its primary income statement impact, each of the following statements is true EXCEPT which is inaccurate?

a. Credit risk primarily affects loan losses

b. Liquidity risk primary affects non-interest expense

c. Operational risk primarily affects non-interest expense

d. Market risk affects net interest income and/or non-interest income

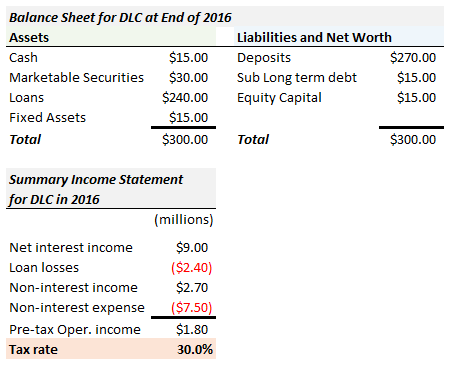

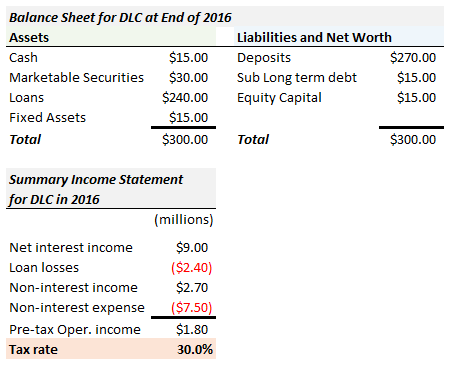

700.2. Below are a summary balance sheet and income statement for Deposits and Loans Corporation (DLC):

Each of the following statements is true EXCEPT which is false?

a. Return on equity (ROE) is 12.0%

b. Leverage is 19.0 or 20.0 (depending on our definition of leverage)

c. If loan losses jump to 6.0% of assets next year, and nothing else changes, this will completely wipe out the equity shareholders

d. If DLC had borrowed $10 million (+$10.0 to Sub Long term debt) to buyback shares (-$10.0 equity) during 2016, its ROE would triple (3x)

700.3. Banks must manage both economic capital and regulatory capital. Each of the following statements is true EXCEPT which is false?

a. If corporations rated "AA" have a one-year default probability of 0.03%, then a reasonable economic capital confidence level is 99.97% for a financial institution with an objective of maintaining a "AA" rating

b. Economic capital is also called risk capital and can be regarded as a sort of "currency" for risk-taking within a financial institution; a business unit can take a certain risk only when it is allocated the appropriate economic capital for that risk.

c. Because sharing information about regulatory capital among divisions of the bank is a conflict of interest, banks construct a so-called Chinese Wall to keep the regulatory capital separate from the economic capital each division, and to separate economic capital among divisions within the bank

d. Economic capital is often less than regulatory capital, but it is also different than regulatory capital (which is prescribed by regulators); banks have no choice but to maintain their capital above the regulatory capital level, although in order to avoid having to raise capital at short notice, banks often maintain capital comfortably above the regulatory minimum

Answers here:

Questions:

700.1. Below is a hypothetical summary income statement for Deposits and Loans Corporation (DLC):

Risks can affect any line in the income statement, but according to Hull, each major risk category tends to be primarily associated with certain activities as they manifest on the financial statements. In regard to this association between a major risk type and its primary income statement impact, each of the following statements is true EXCEPT which is inaccurate?

a. Credit risk primarily affects loan losses

b. Liquidity risk primary affects non-interest expense

c. Operational risk primarily affects non-interest expense

d. Market risk affects net interest income and/or non-interest income

700.2. Below are a summary balance sheet and income statement for Deposits and Loans Corporation (DLC):

Each of the following statements is true EXCEPT which is false?

a. Return on equity (ROE) is 12.0%

b. Leverage is 19.0 or 20.0 (depending on our definition of leverage)

c. If loan losses jump to 6.0% of assets next year, and nothing else changes, this will completely wipe out the equity shareholders

d. If DLC had borrowed $10 million (+$10.0 to Sub Long term debt) to buyback shares (-$10.0 equity) during 2016, its ROE would triple (3x)

700.3. Banks must manage both economic capital and regulatory capital. Each of the following statements is true EXCEPT which is false?

a. If corporations rated "AA" have a one-year default probability of 0.03%, then a reasonable economic capital confidence level is 99.97% for a financial institution with an objective of maintaining a "AA" rating

b. Economic capital is also called risk capital and can be regarded as a sort of "currency" for risk-taking within a financial institution; a business unit can take a certain risk only when it is allocated the appropriate economic capital for that risk.

c. Because sharing information about regulatory capital among divisions of the bank is a conflict of interest, banks construct a so-called Chinese Wall to keep the regulatory capital separate from the economic capital each division, and to separate economic capital among divisions within the bank

d. Economic capital is often less than regulatory capital, but it is also different than regulatory capital (which is prescribed by regulators); banks have no choice but to maintain their capital above the regulatory capital level, although in order to avoid having to raise capital at short notice, banks often maintain capital comfortably above the regulatory minimum

Answers here:

Last edited by a moderator: