Learning objectives: Explain how to use regression analysis to model seasonality. Explain how to construct an h-step-ahead point forecast.

Questions:

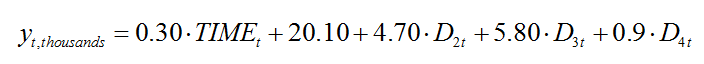

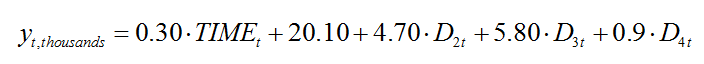

701.1. Based on a regression analysis, the following model was produced to predict housing starts (given in thousands) within a certain geographical region; e.g., one of the larger U.S. states. The time series model contains both a trend and a seasonal component and is given by the following:

The trend component is reflected in the variable, TIME(t), where (t) is the month. Seasonality is reflected by the intercept (20.10) plus the three seasonal dummy variables (D2, D3 and D4) in order to capture quarterly seasonality. Winter includes December, January and February. Spring includes March, April and May and is indicated by dummy D(2t). Summer includes June, July and August and is indicated by dummy D(3t). Finally, fall includes September, October and November and is indicated by D(4t).

The model starts in November 2016; for example, y(T+1) refers to December 2016 and y(T+2) refers to January 2017. What does the model predict for October 2018?

a. 24,700

b. 26,100

c. 27,900

d. 30,500

701.2. Your colleague Daniel employs a pure seasonal model to forecast housing starts:

His model contains a full set of standard monthly variables; that is, the model has no intercept but rather D(1) = (1, 0, 0, ....), D(2) = (0, 1, 0, 0, ...), D(3) = (0, 0, 1, 0, ...), and so on up to D(12). His regression results include R^2, adjusted R^2, a Durbin-Watson statistic, an F-statistic, an Akaike information criterion (AIC), and a Schwarz Criterion (SIC). Each of the following statements is plausible or true EXCEPT which statement is probably false?

a. A Durbin-Watson statistic of 0.150 indicates positive autocorrelation and suggests the possibility of a cyclical trend

b. If the regression disturbances are white noise, the standard F-test can be used to test the hypothesis of no seasonality

c. To evaluate the model for step-ahead forecasts, the Schwarz information criteria (SIC) is generlly superior to the R-squared

d. If we changed the first dummy variable to D1 = (2, 0, 0, ....) then all of the seasonal factors, γ(1), γ(2), ..., γ(s) will double in magnitude

701.3. The following time series model predicts trading volume for a certain commodity:

Seasonality in the model is captured by the monthly dummy variables; eg, D2(t) refers to February, D12(t) refers to December. In addition to the monthly seasonal dummy variables, the model incorporates trading day variation, TDV(t). The model's first step is January 2017 such that y(0) refers to December 2016 and TIME(1) refers to January 2017. January 2017 has 20 trading days (ie, January 2017 has 22 workdays minus observed New Year's Day and Martin Luther King Jr Day) while January 2018 has 21 trading days. What does the model predict for trading volume in January 2018, which steps ahead 13 months as given by y(T+13)?

a. 173,000

b. 308,600

c. 430,200

d. 437,500

Answers here:

Questions:

701.1. Based on a regression analysis, the following model was produced to predict housing starts (given in thousands) within a certain geographical region; e.g., one of the larger U.S. states. The time series model contains both a trend and a seasonal component and is given by the following:

The trend component is reflected in the variable, TIME(t), where (t) is the month. Seasonality is reflected by the intercept (20.10) plus the three seasonal dummy variables (D2, D3 and D4) in order to capture quarterly seasonality. Winter includes December, January and February. Spring includes March, April and May and is indicated by dummy D(2t). Summer includes June, July and August and is indicated by dummy D(3t). Finally, fall includes September, October and November and is indicated by D(4t).

The model starts in November 2016; for example, y(T+1) refers to December 2016 and y(T+2) refers to January 2017. What does the model predict for October 2018?

a. 24,700

b. 26,100

c. 27,900

d. 30,500

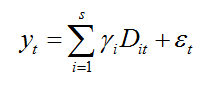

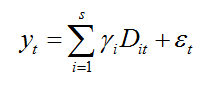

701.2. Your colleague Daniel employs a pure seasonal model to forecast housing starts:

His model contains a full set of standard monthly variables; that is, the model has no intercept but rather D(1) = (1, 0, 0, ....), D(2) = (0, 1, 0, 0, ...), D(3) = (0, 0, 1, 0, ...), and so on up to D(12). His regression results include R^2, adjusted R^2, a Durbin-Watson statistic, an F-statistic, an Akaike information criterion (AIC), and a Schwarz Criterion (SIC). Each of the following statements is plausible or true EXCEPT which statement is probably false?

a. A Durbin-Watson statistic of 0.150 indicates positive autocorrelation and suggests the possibility of a cyclical trend

b. If the regression disturbances are white noise, the standard F-test can be used to test the hypothesis of no seasonality

c. To evaluate the model for step-ahead forecasts, the Schwarz information criteria (SIC) is generlly superior to the R-squared

d. If we changed the first dummy variable to D1 = (2, 0, 0, ....) then all of the seasonal factors, γ(1), γ(2), ..., γ(s) will double in magnitude

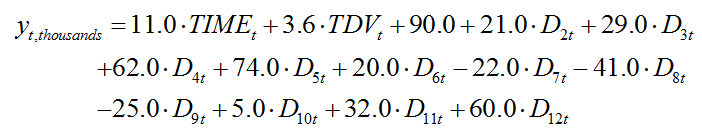

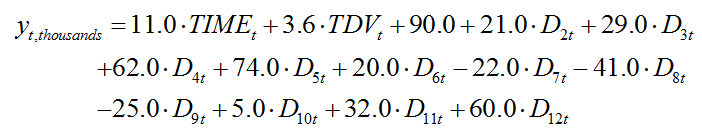

701.3. The following time series model predicts trading volume for a certain commodity:

Seasonality in the model is captured by the monthly dummy variables; eg, D2(t) refers to February, D12(t) refers to December. In addition to the monthly seasonal dummy variables, the model incorporates trading day variation, TDV(t). The model's first step is January 2017 such that y(0) refers to December 2016 and TIME(1) refers to January 2017. January 2017 has 20 trading days (ie, January 2017 has 22 workdays minus observed New Year's Day and Martin Luther King Jr Day) while January 2018 has 21 trading days. What does the model predict for trading volume in January 2018, which steps ahead 13 months as given by y(T+13)?

a. 173,000

b. 308,600

c. 430,200

d. 437,500

Answers here:

Last edited by a moderator: