Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

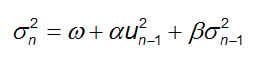

409.1. Consider the following general form of the GARCH(1,1) for the estimate of today's (daily) variance:

You are comparing four versions with the following parameters:

#1. omega = 0.0000120, alpha = 0.060, beta = 0.820

#2. omega = 0.0000120, alpha = 0.050, beta = 0.880

#3. omega = 0.0000160, alpha = 0.070, beta = 0.900

#4. omega = 0.0000450, alpha = 0.040, beta = 0.910

Each of the following statements is true EXCEPT which is false?

a. Each of the four models is (covariance) stationary

b. Model #1 has the highest weight assigned to its long-run (unconditional) variance; i.e., highest gamma

c. Model #2 will revert fastest to its long-run (unconditional) variance

d. Model #4 has the highest long-run (unconditional) variance

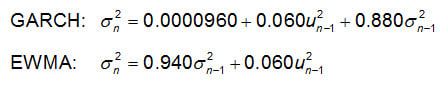

409.2. Peter the risk analyst is trying to decide between two different volatility models, a GARCH(1,1) model and exponentially weighted moving average (EWMA) model. The parameters for each are given below:

With respect to his historical data series, the most recent (yesterday's) daily volatility was 12.0% and yesterday's daily return was +8.0%. Which of the following statements is true?

a. The long-run (unconditional) volatility implied by the GARCH model is 10.0%

b. In both models, the weights assigned to historical returns-squared decline exponentially at a rate of 94.0%

c. The updated exponentially weighted moving average (EWMA) volatility estimate is about 11.80%

d. The GARCH forecast of volatility in twenty days, sigma^2(n+20), is greater than 12.0%

Answers here:

Questions:

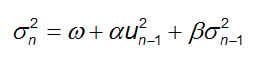

409.1. Consider the following general form of the GARCH(1,1) for the estimate of today's (daily) variance:

You are comparing four versions with the following parameters:

#1. omega = 0.0000120, alpha = 0.060, beta = 0.820

#2. omega = 0.0000120, alpha = 0.050, beta = 0.880

#3. omega = 0.0000160, alpha = 0.070, beta = 0.900

#4. omega = 0.0000450, alpha = 0.040, beta = 0.910

Each of the following statements is true EXCEPT which is false?

a. Each of the four models is (covariance) stationary

b. Model #1 has the highest weight assigned to its long-run (unconditional) variance; i.e., highest gamma

c. Model #2 will revert fastest to its long-run (unconditional) variance

d. Model #4 has the highest long-run (unconditional) variance

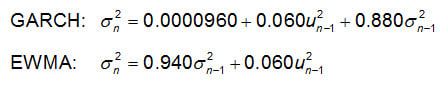

409.2. Peter the risk analyst is trying to decide between two different volatility models, a GARCH(1,1) model and exponentially weighted moving average (EWMA) model. The parameters for each are given below:

With respect to his historical data series, the most recent (yesterday's) daily volatility was 12.0% and yesterday's daily return was +8.0%. Which of the following statements is true?

a. The long-run (unconditional) volatility implied by the GARCH model is 10.0%

b. In both models, the weights assigned to historical returns-squared decline exponentially at a rate of 94.0%

c. The updated exponentially weighted moving average (EWMA) volatility estimate is about 11.80%

d. The GARCH forecast of volatility in twenty days, sigma^2(n+20), is greater than 12.0%

Answers here:

Last edited by a moderator: