Suzanne Evans

Well-Known Member

AIMs: Describe the concept of probability. Describe and distinguish between continuous and discrete random variables. Define and distinguish between the probability density function, the cumulative distribution function and the inverse cumulative distribution function, and calculate probabilities based on each of these functions.

Questions:

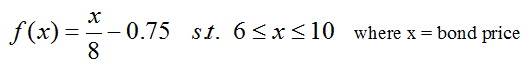

300.1. Assume the probability density function (pdf) of a zero-coupon bond with a notional value of $10.00 is given by f(x) = x/8 - 0.75 on the domain [6,10] where x is the price of the bond:

What is the probability that the price of the bond is between $8.00 and $9.00?

a. 25.750%

b. 28.300%

c. 31.250%

d. 44.667%

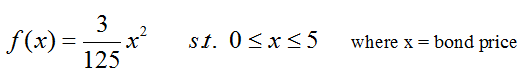

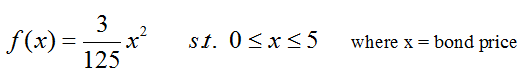

300.2. Assume the probability density function (pdf) of a zero-coupon bond with a notional value of $5.00 is given by f(x) = (3/125)*x^2 on the domain [0,5] where x is the price of the bond:

If we apply the inverse cumulative distribution function and find the price of the bond (i.e., the value of x) such that 5.0% of the distribution is less than or equal to (x), what is this price; in other words, since this is a 5% quantile function, what is the 95% value at risk (VaR)?

a. $0.379

b. $1.842

c. $2.015

d. $2.425

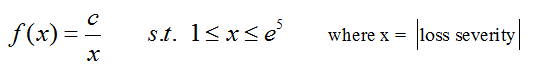

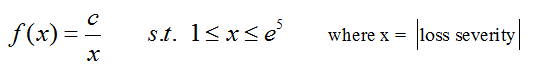

300.3. Assume a loss severity given by (x) can be characterized by a probability density function (pdf) on the domain [1, e^5]. For example, the minimum loss severity = $1 and the maximum possible loss severity = exp(5) ~= $148.41. The pdf is given by f(x) = c/x as follows:

What is the 95.0% value at risk (VaR); i.e., given that losses are expressed in positive values, at what loss severity value (x) is only 5.0% of the distribution greater than (x)?

a. $54.42

b. $97.26

c. $115.58

d. $139.04

Answers:

Questions:

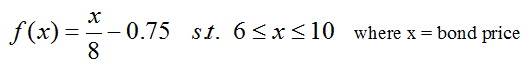

300.1. Assume the probability density function (pdf) of a zero-coupon bond with a notional value of $10.00 is given by f(x) = x/8 - 0.75 on the domain [6,10] where x is the price of the bond:

What is the probability that the price of the bond is between $8.00 and $9.00?

a. 25.750%

b. 28.300%

c. 31.250%

d. 44.667%

300.2. Assume the probability density function (pdf) of a zero-coupon bond with a notional value of $5.00 is given by f(x) = (3/125)*x^2 on the domain [0,5] where x is the price of the bond:

If we apply the inverse cumulative distribution function and find the price of the bond (i.e., the value of x) such that 5.0% of the distribution is less than or equal to (x), what is this price; in other words, since this is a 5% quantile function, what is the 95% value at risk (VaR)?

a. $0.379

b. $1.842

c. $2.015

d. $2.425

300.3. Assume a loss severity given by (x) can be characterized by a probability density function (pdf) on the domain [1, e^5]. For example, the minimum loss severity = $1 and the maximum possible loss severity = exp(5) ~= $148.41. The pdf is given by f(x) = c/x as follows:

What is the 95.0% value at risk (VaR); i.e., given that losses are expressed in positive values, at what loss severity value (x) is only 5.0% of the distribution greater than (x)?

a. $54.42

b. $97.26

c. $115.58

d. $139.04

Answers: