AIMs: Construct, perform, and interpret hypothesis tests and confidence intervals for: a single coefficient in a multiple regression; and for multiple coefficients in a multiple regression. Define and interpret the F-statistic.

Questions:

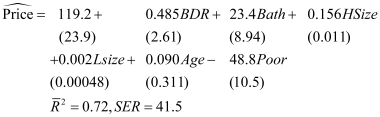

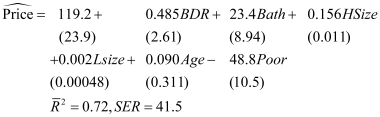

221.1. This question was sourced from Stock & Watson; the regression also applies to the next question. Data were collected from a random sample of 220 home sales. Price is the regressand (dependent variable) and denotes the selling price (in $1,000s). The regressors (independent variables) are: BDR is number of bedrooms, Bath is number of bathrooms, HSize is size of house in square feet, LSize is lot size (in square feet), Age is age of house (in years), and Poor is a binary variable that is equal to one (1) if the condition of the house is reported as "poor." The estimate regression, with included standard errors, is given by:

If a homeowner purchases 1,000 square feet from an adjacent lot (i.e., +1,000 to her lot size), what is the 99% confidence interval for the change in value to her house?

a. +$76 to $324

b. +$275 to $1,512

c. +$763 to $3,236

d. +1,255 to $4,871

221.2. Assume the same multiple regression as above, and note the regression has six regressors. The F-statistic for omitting BDR and Age from the regression is 3.31. The following four critical value are provided to you from Table 4 in the Appendix: critical F(2 df, infinite) @ 5% = 3.00; F(2 df, infinite) @ 1% = 4.61; F(6 df, infinite) @ 5% = 2.01; F(6 df, infinite) @ 1% = 2.64. Are the coefficients BDR and Age statistically different from zero at, respectively, the 5% and 1% level?

a. No, they are not significant at either level

b. They are not significant at 5%, but they are significant at 1%

c. They are not significant at 1%, but they are significant at 5%

d. Yes, they are significant at both 5% and 1%

221.3. In regard to hypothesis tests in a multiple regression, each of the following is true EXCEPT which of the following is false:

a. In the multiple regression model, the t-statistic for testing that the slope is significantly different from zero is calculated by dividing the estimate by its standard error

b. To test the joint null hypothesis at 5% significance, we can use the t-statistic to test each coefficient (one at a time) and, if any t-statistic exceeds 1.96, we can reject the joint null

c. When testing a joint hypothesis, we should use the F-statistic and reject at least one of the hypothesis if the statistic exceeds the critical value

d. When the number of restrictions is one (q=1), the joint null hypothesis reduces to the null hypothesis on a single regression coefficient, and the F-statistic is the square of the t-statistic; e.g., the critical F(1, infinite) at 5% = 1.96^2

Answers:

Questions:

221.1. This question was sourced from Stock & Watson; the regression also applies to the next question. Data were collected from a random sample of 220 home sales. Price is the regressand (dependent variable) and denotes the selling price (in $1,000s). The regressors (independent variables) are: BDR is number of bedrooms, Bath is number of bathrooms, HSize is size of house in square feet, LSize is lot size (in square feet), Age is age of house (in years), and Poor is a binary variable that is equal to one (1) if the condition of the house is reported as "poor." The estimate regression, with included standard errors, is given by:

If a homeowner purchases 1,000 square feet from an adjacent lot (i.e., +1,000 to her lot size), what is the 99% confidence interval for the change in value to her house?

a. +$76 to $324

b. +$275 to $1,512

c. +$763 to $3,236

d. +1,255 to $4,871

221.2. Assume the same multiple regression as above, and note the regression has six regressors. The F-statistic for omitting BDR and Age from the regression is 3.31. The following four critical value are provided to you from Table 4 in the Appendix: critical F(2 df, infinite) @ 5% = 3.00; F(2 df, infinite) @ 1% = 4.61; F(6 df, infinite) @ 5% = 2.01; F(6 df, infinite) @ 1% = 2.64. Are the coefficients BDR and Age statistically different from zero at, respectively, the 5% and 1% level?

a. No, they are not significant at either level

b. They are not significant at 5%, but they are significant at 1%

c. They are not significant at 1%, but they are significant at 5%

d. Yes, they are significant at both 5% and 1%

221.3. In regard to hypothesis tests in a multiple regression, each of the following is true EXCEPT which of the following is false:

a. In the multiple regression model, the t-statistic for testing that the slope is significantly different from zero is calculated by dividing the estimate by its standard error

b. To test the joint null hypothesis at 5% significance, we can use the t-statistic to test each coefficient (one at a time) and, if any t-statistic exceeds 1.96, we can reject the joint null

c. When testing a joint hypothesis, we should use the F-statistic and reject at least one of the hypothesis if the statistic exceeds the critical value

d. When the number of restrictions is one (q=1), the joint null hypothesis reduces to the null hypothesis on a single regression coefficient, and the F-statistic is the square of the t-statistic; e.g., the critical F(1, infinite) at 5% = 1.96^2

Answers: