yeng18950

New Member

Hello,

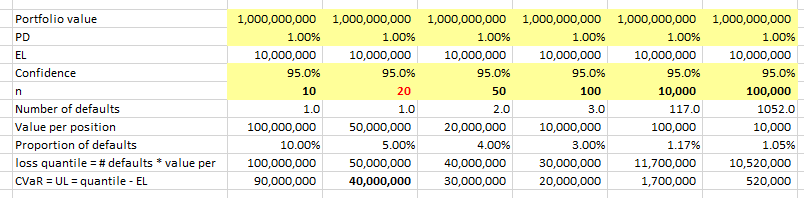

On page 8 of the study notes for P1.T1.Ch1, a statement is made about the relationship between actual loss & expected loss "The more granular (aka, less lumpy) is the credit portfolio, the more the actual losses should converge on the expected loss."

Would you please elaborate on this statement with an example, preferably a quantitative example if possible?

Thank you,

On page 8 of the study notes for P1.T1.Ch1, a statement is made about the relationship between actual loss & expected loss "The more granular (aka, less lumpy) is the credit portfolio, the more the actual losses should converge on the expected loss."

Would you please elaborate on this statement with an example, preferably a quantitative example if possible?

Thank you,