Learning outcomes: Analyze various factors that contributed to the Credit Crisis of 2007 and examine the relationships between these factors. Describe the mechanics of asset-backed securities (ABS) and ABS collateralized debt obligations (ABS CDOs) and explain their role in the 2007 credit crisis.

Questions:

509.1. It is a consensus that not one but several factors contributed to the Credit Crisis of 2007. According to John Hull, each of the following is a key contributing factor EXCEPT which does he not cite as a key factor?

a. There was a relaxation of the criteria used for mortgage lending; in many cases, mortgage originators used lax lending standards

b. The widespread reliance on market value-at-risk (MVaR) as the key risk metric at major banks enabled a chain of downgrades and promulgated a procyclical contagion

c. Rating agencies moved from their traditional business of rating bonds (where they had a great deal of experience) to rating structured products (which were relatively new and for which there were relatively little historical data)

d. Products were developed to enable mortgage originators to profitably transfer credit risk to investors, but the products bought by investors were complex and in many instances investors and rating agencies had inaccurate or incomplete information about the quality of the underlying assets

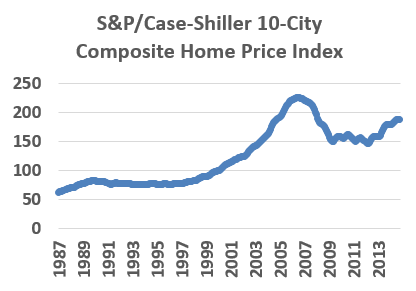

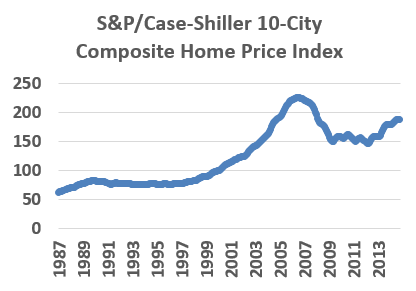

509.2. Hull writes "A natural starting point for a discussion of the credit crisis of 2007 is the U.S. housing market. [The chart below] shows the S&P/Case-Shiller composite-10 index for house prices in the United States between January 1987 and July 2011. This tracks house prices for ten major metropolitan areas in the United States. In about the year 2000, house prices started to rise much faster than they had in the previous decade. The very low level of interest rates between 2002 and 2005 was an important contributory factor, but the bubble in house prices was largely fueled by mortgage lending practices."

An economic bubble has both a boom and a bust. According to Hull, each of the following is true about the US home price bubble EXCEPT which is not?

a. Since the 1990s, the U.S. government had been promoting home ownership. Some concerned state legislators did want to curtail perceived, predatory lending practices, but the courts decided that national standards should prevail (contributing to price boom)

b. Adjustable rate mortgages (ARMs) with low teaser rates increased in popularity, but some borrowers with teaser rates found that they could no longer afford their mortgages when the teaser rates ended. This led to foreclosures and an increase in the supply of houses for sale (contributing to boom and exacerbating bust)

c. Because in the US mortgage loans are full recourse, while most mortgage loans outside the US are non-recourse, lenders effectively held an American-style put option which they often exercised, even as borrows would have preferred to keep their homes. The practice put upward pressure on house prices (contributing to price boom)

d. As foreclosures increased, the losses on mortgages also increased. Losses were high because houses in foreclosure were often surrounded by other houses that were also for sale. They were sometimes in poor condition. In addition, banks faced legal and other fees. In normal market conditions, a lender can expect to recover 75% of the amount owing in a foreclosure. In 2008 and 2009, recovery rates as low as 25% were experienced in some areas (exacerbating price bust)

509.3. About collateralized debt obligations (aka, ABS CDO as CDOs are a type of asset-backed security) Hull writes, "Finding investors to buy the senior AAA-rated tranches created from subprime mortgages was not difficult. Equity tranches were typically retained by the originator of the mortgages or sold to a hedge fund. Finding investors for the mezzanine tranches was more difficult." Which of the following statements is TRUE about asset-backed securities (ABS) and/or ABS collateralized debt obligations (ABS CDOs)?

a. As default correlation decreases, the senior tranche of an ABS becomes more risky because it is more likely to suffer losses

b. Compared to a bond with a BBB rating, the mezzanine tranche of a CDO with a BBB rating has an identical, or at least highly similar, probability distribution

c. The senior tranche of the ABS CDO was rated AAA and, at the time of the crises, AAA-rated tranches were much thicker--e.g., often 90% or more of the principal of the underlying mortgage portfolios--than the mezzanine and equity tranches

d. In the ABS CDO, a "waterfall" occurs when investors became reluctant to take any credit risk and instead prefer to buy Treasury instruments and similarly safe investments. This "cascades" into a sharp widening of credit spreads (i.e., the extra return required for taking credit risks)

Answers:

Questions:

509.1. It is a consensus that not one but several factors contributed to the Credit Crisis of 2007. According to John Hull, each of the following is a key contributing factor EXCEPT which does he not cite as a key factor?

a. There was a relaxation of the criteria used for mortgage lending; in many cases, mortgage originators used lax lending standards

b. The widespread reliance on market value-at-risk (MVaR) as the key risk metric at major banks enabled a chain of downgrades and promulgated a procyclical contagion

c. Rating agencies moved from their traditional business of rating bonds (where they had a great deal of experience) to rating structured products (which were relatively new and for which there were relatively little historical data)

d. Products were developed to enable mortgage originators to profitably transfer credit risk to investors, but the products bought by investors were complex and in many instances investors and rating agencies had inaccurate or incomplete information about the quality of the underlying assets

509.2. Hull writes "A natural starting point for a discussion of the credit crisis of 2007 is the U.S. housing market. [The chart below] shows the S&P/Case-Shiller composite-10 index for house prices in the United States between January 1987 and July 2011. This tracks house prices for ten major metropolitan areas in the United States. In about the year 2000, house prices started to rise much faster than they had in the previous decade. The very low level of interest rates between 2002 and 2005 was an important contributory factor, but the bubble in house prices was largely fueled by mortgage lending practices."

An economic bubble has both a boom and a bust. According to Hull, each of the following is true about the US home price bubble EXCEPT which is not?

a. Since the 1990s, the U.S. government had been promoting home ownership. Some concerned state legislators did want to curtail perceived, predatory lending practices, but the courts decided that national standards should prevail (contributing to price boom)

b. Adjustable rate mortgages (ARMs) with low teaser rates increased in popularity, but some borrowers with teaser rates found that they could no longer afford their mortgages when the teaser rates ended. This led to foreclosures and an increase in the supply of houses for sale (contributing to boom and exacerbating bust)

c. Because in the US mortgage loans are full recourse, while most mortgage loans outside the US are non-recourse, lenders effectively held an American-style put option which they often exercised, even as borrows would have preferred to keep their homes. The practice put upward pressure on house prices (contributing to price boom)

d. As foreclosures increased, the losses on mortgages also increased. Losses were high because houses in foreclosure were often surrounded by other houses that were also for sale. They were sometimes in poor condition. In addition, banks faced legal and other fees. In normal market conditions, a lender can expect to recover 75% of the amount owing in a foreclosure. In 2008 and 2009, recovery rates as low as 25% were experienced in some areas (exacerbating price bust)

509.3. About collateralized debt obligations (aka, ABS CDO as CDOs are a type of asset-backed security) Hull writes, "Finding investors to buy the senior AAA-rated tranches created from subprime mortgages was not difficult. Equity tranches were typically retained by the originator of the mortgages or sold to a hedge fund. Finding investors for the mezzanine tranches was more difficult." Which of the following statements is TRUE about asset-backed securities (ABS) and/or ABS collateralized debt obligations (ABS CDOs)?

a. As default correlation decreases, the senior tranche of an ABS becomes more risky because it is more likely to suffer losses

b. Compared to a bond with a BBB rating, the mezzanine tranche of a CDO with a BBB rating has an identical, or at least highly similar, probability distribution

c. The senior tranche of the ABS CDO was rated AAA and, at the time of the crises, AAA-rated tranches were much thicker--e.g., often 90% or more of the principal of the underlying mortgage portfolios--than the mezzanine and equity tranches

d. In the ABS CDO, a "waterfall" occurs when investors became reluctant to take any credit risk and instead prefer to buy Treasury instruments and similarly safe investments. This "cascades" into a sharp widening of credit spreads (i.e., the extra return required for taking credit risks)

Answers: