Suzanne Evans

Well-Known Member

AIM: Compare and contrast the different types of probabilistic approaches used to estimate value and contrast probabilistic approaches in general with risk-adjusted methods.

Questions:

304.1. Peter analyzes a project with that will require an initial investment (cash outflow) of $50.0 million but will return an expected cash inflow of $100 million at the end of the fourth year. He estimates the project's cost of capital (a.k.a., WACC, discount rate) to be 6.00%. His colleague Sally points out that, while the initial investment is certain, the other assumptions are uncertain. She says the returned cash inflow could vary by up to +/-20% of the expectation; the timing of the inflow could be up to one year earlier or later; and the true cost of capital might vary by plus/minus (+/-) 90 basis points from Peter's estimate. Under an annual compound frequency, what is the worst-case net present value (NPV) of the project?

a. -$4.60 million

b. +$7.31 million

c. +$15.95 million

d. +$21.21 million

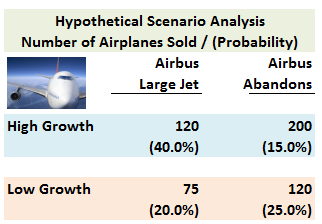

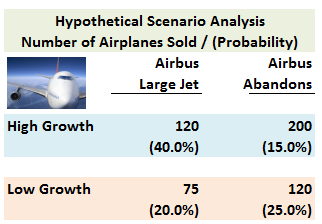

304.2. Boeing, a leading global aircraft manufacturer, is considering the introduction of a new, large capacity airplane called the Super Jumbo, to replace the Boeing 747. Cash flows will depend on two major, uncontrollable factors: growth in the long-haul international market, and the likelihood that the company's primary competitor--Airbus--will come out with a larger version of its largest capacity airplane over the period of the analysis. For each of these two factors, there are two possible outcomes:

For example, there is a 40% joint probability that both the international market experiences high growth and Airbus builds a large, competing jet: under this scenario, Boeing will sell 120 airplanes. Boeing's management defines a probability threshold as the expected (mean) number sold minus one standard deviation; i.e., mu minus one sigma. If the threshold is 100 airplanes, should Boeing build the airplane?

a. No, mean minus one sigma is negative!

b. No, mean minus one sigma is ~ 86 airplanes

c. Yes, mean minus one sigma is ~ 107 airplanes

d. Yes, mean minus one sigma is ~ 164 airplanes

304.3. According to the World Bank's IFC, each of the following is true EXCEPT for:

a. Probabilistic approaches include sensitivity analysis, scenario analysis and simulations

b. A simulation allows for the deepest assessment of uncertainty because it lets analysts specify distributions of values rather than a single expected value for each input

c. Certainty-equivalent value is the value at risk (VaR) of a risk-adjusted value

d. The output of a simulation can used to to generate a value at risk (VaR)

Answers:

Questions:

304.1. Peter analyzes a project with that will require an initial investment (cash outflow) of $50.0 million but will return an expected cash inflow of $100 million at the end of the fourth year. He estimates the project's cost of capital (a.k.a., WACC, discount rate) to be 6.00%. His colleague Sally points out that, while the initial investment is certain, the other assumptions are uncertain. She says the returned cash inflow could vary by up to +/-20% of the expectation; the timing of the inflow could be up to one year earlier or later; and the true cost of capital might vary by plus/minus (+/-) 90 basis points from Peter's estimate. Under an annual compound frequency, what is the worst-case net present value (NPV) of the project?

a. -$4.60 million

b. +$7.31 million

c. +$15.95 million

d. +$21.21 million

304.2. Boeing, a leading global aircraft manufacturer, is considering the introduction of a new, large capacity airplane called the Super Jumbo, to replace the Boeing 747. Cash flows will depend on two major, uncontrollable factors: growth in the long-haul international market, and the likelihood that the company's primary competitor--Airbus--will come out with a larger version of its largest capacity airplane over the period of the analysis. For each of these two factors, there are two possible outcomes:

For example, there is a 40% joint probability that both the international market experiences high growth and Airbus builds a large, competing jet: under this scenario, Boeing will sell 120 airplanes. Boeing's management defines a probability threshold as the expected (mean) number sold minus one standard deviation; i.e., mu minus one sigma. If the threshold is 100 airplanes, should Boeing build the airplane?

a. No, mean minus one sigma is negative!

b. No, mean minus one sigma is ~ 86 airplanes

c. Yes, mean minus one sigma is ~ 107 airplanes

d. Yes, mean minus one sigma is ~ 164 airplanes

304.3. According to the World Bank's IFC, each of the following is true EXCEPT for:

a. Probabilistic approaches include sensitivity analysis, scenario analysis and simulations

b. A simulation allows for the deepest assessment of uncertainty because it lets analysts specify distributions of values rather than a single expected value for each input

c. Certainty-equivalent value is the value at risk (VaR) of a risk-adjusted value

d. The output of a simulation can used to to generate a value at risk (VaR)

Answers: