Kavita.bhangdia

Active Member

Hi David,

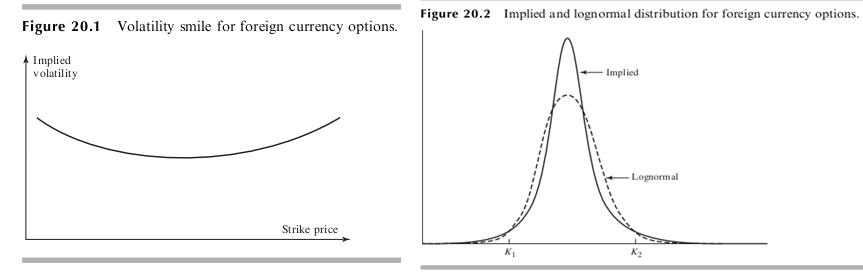

How do we find the shape on the implied vol curve based on the shape of distribution of underlying..

Thanks

Kavita

How do we find the shape on the implied vol curve based on the shape of distribution of underlying..

Thanks

Kavita

Last edited: