Questions:

1. While the current stock price is $32.00, a European call option on the stock with a strike price of $30.00 and one (1.0) year to maturity has a price of $5.26 and an implied volatility of 30.0% per annum. A European put on the same stock, with the identical strike price and maturity, has a price of $3.42 and an implied volatility of 39.0% per annum. What is the arbitrage trade, assuming no transaction costs, and resulting net profit in one year (at maturity)?

a. Buy the stock, buy the put, short the call, and invest cash at risk-less rate for future net profit of $0.55

b. Short the stock, short the put, buy the call, and invest cash at risk-less rate for future net profit of $1.07

c. Short the stock, buy the put, short the call, and borrow cash at risk-less rate for future net profit of $2.25

d. No arbitrage: the higher implied volatility is natural to the volatility skew of equities

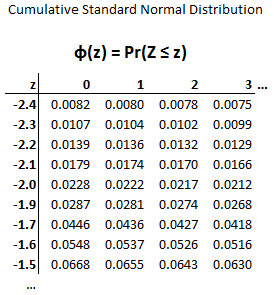

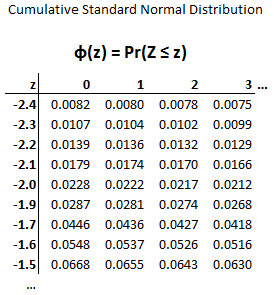

2. A cash-or-nothing binary (aka, digital) option pays $100.00 at maturity in six months (0.5 years) if the option expires in the money. The binary options's strike price is $30.00 and the current price of the non-dividend-paying stock is $40.00 with volatility of 22.0% per annum. The risk-free rate is 4.0%. Please use this snippet of a the cumulative standard normal distribution function table which returns the cumulative probability (CDF) for a given z-value:

Which is nearest to the current price of the binary option?

a. $88.50

b. $91.47

c. $95.21

d. $97.13

3. Assume it is January 1st and your company's treasurer realizes that on June 1st, the company will need to issue $100.0 million in commercial paper with a maturity of 180 days. If the paper were issued "today" (January 1st) the company would realize $97,266,800 because its cost to borrow is a simple interest rate of 5.620% per annum; i.e., $100/(1 + 5.620%*180/360) ~= $97.26680. The June Eurodollar futures price is quoted as 97.00.

How should the treasurer hedge the company's interest rate exposure? (source: variation on Hull's 2012 Problem 6.16)

a. Long 88 Eurodollar futures contracts

b. Long 205 Eurodollar futures contracts

c. Short 75 Eurodollar futures contracts

d. Short 196 Eurodollar futures contracts

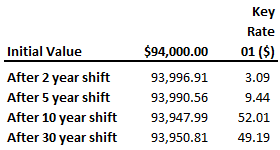

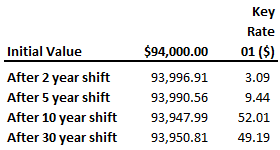

4. Your colleague Roger calculated a set of key rate 01s (KR01) for a bond and shared them with you, below, but he forgot to include the bond's specifications. He informs you that, although he selected only four key rates (two, five, 10 and 30 year), neighboring rates are shifted in a linear (interpolation) manner such that the entire term structure is characterized by the model. Here are the four key rates (KR01s), along with the bond's price of $94,000.00.

Which is nearest to the bond's modified duration?

a. 7.5 years

b. 12.1 years

c. 18.6 years

d. 23.0 years

5. A pass-through mortgage-backed security (MBS) represents claims on an mortgage pool with an original principal balance of $1.0 billion and a weighted average maturity (WAM) of 240 months. The pricing model assumes a 150% Public Securities Association (150% PSA) prepayment speed. At the end of 36 months, the principal balance is expected to be reduced to $842.0 million, due to both scheduled principal and prepaid principal. In the 37th month, which is the first month of the fourth year, what will be the expected principal prepayment; i.e., prepaid principal only, not scheduled principal?

a. $4,210,750

b. $5,763,270

c. $6,315,000

d. $6,591,510

Answers:

1. While the current stock price is $32.00, a European call option on the stock with a strike price of $30.00 and one (1.0) year to maturity has a price of $5.26 and an implied volatility of 30.0% per annum. A European put on the same stock, with the identical strike price and maturity, has a price of $3.42 and an implied volatility of 39.0% per annum. What is the arbitrage trade, assuming no transaction costs, and resulting net profit in one year (at maturity)?

a. Buy the stock, buy the put, short the call, and invest cash at risk-less rate for future net profit of $0.55

b. Short the stock, short the put, buy the call, and invest cash at risk-less rate for future net profit of $1.07

c. Short the stock, buy the put, short the call, and borrow cash at risk-less rate for future net profit of $2.25

d. No arbitrage: the higher implied volatility is natural to the volatility skew of equities

2. A cash-or-nothing binary (aka, digital) option pays $100.00 at maturity in six months (0.5 years) if the option expires in the money. The binary options's strike price is $30.00 and the current price of the non-dividend-paying stock is $40.00 with volatility of 22.0% per annum. The risk-free rate is 4.0%. Please use this snippet of a the cumulative standard normal distribution function table which returns the cumulative probability (CDF) for a given z-value:

Which is nearest to the current price of the binary option?

a. $88.50

b. $91.47

c. $95.21

d. $97.13

3. Assume it is January 1st and your company's treasurer realizes that on June 1st, the company will need to issue $100.0 million in commercial paper with a maturity of 180 days. If the paper were issued "today" (January 1st) the company would realize $97,266,800 because its cost to borrow is a simple interest rate of 5.620% per annum; i.e., $100/(1 + 5.620%*180/360) ~= $97.26680. The June Eurodollar futures price is quoted as 97.00.

How should the treasurer hedge the company's interest rate exposure? (source: variation on Hull's 2012 Problem 6.16)

a. Long 88 Eurodollar futures contracts

b. Long 205 Eurodollar futures contracts

c. Short 75 Eurodollar futures contracts

d. Short 196 Eurodollar futures contracts

4. Your colleague Roger calculated a set of key rate 01s (KR01) for a bond and shared them with you, below, but he forgot to include the bond's specifications. He informs you that, although he selected only four key rates (two, five, 10 and 30 year), neighboring rates are shifted in a linear (interpolation) manner such that the entire term structure is characterized by the model. Here are the four key rates (KR01s), along with the bond's price of $94,000.00.

Which is nearest to the bond's modified duration?

a. 7.5 years

b. 12.1 years

c. 18.6 years

d. 23.0 years

5. A pass-through mortgage-backed security (MBS) represents claims on an mortgage pool with an original principal balance of $1.0 billion and a weighted average maturity (WAM) of 240 months. The pricing model assumes a 150% Public Securities Association (150% PSA) prepayment speed. At the end of 36 months, the principal balance is expected to be reduced to $842.0 million, due to both scheduled principal and prepaid principal. In the 37th month, which is the first month of the fourth year, what will be the expected principal prepayment; i.e., prepaid principal only, not scheduled principal?

a. $4,210,750

b. $5,763,270

c. $6,315,000

d. $6,591,510

Answers: