Questions:

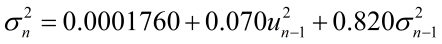

6. The following parameters have been estimated for a GARCH(1,1) model which gives an estimate of today's daily volatility (today = day n):

Yesterday's (n-1) daily volatility was 2.0% and yesterday's daily return was -7.0%. What is the GARCH(1,1) estimate of the daily volatility in 20 days (that is, the estimated volatility on day n+20)?

a. 1.50%

b. 2.85%

c. 3.91%

d. 4.23%

7. Let B and Y represent random normal variables: B ~ N(300, 200^2) and Y ~ N(200,150^2). Let A characterize the average of a random sample of 100 draws (trials) from B, and let X characterize the average of a random sample of 100 draws from Y. We can assume that A and X are independent. What is the joint probability Pr[ A < 253.40, X < 170.60]?

a. 0.050%

b. 0.225%

c. 0.667%

d. 1.305%

8. A stock has a price today of $52.00, an expected return of 14.0% per annum and a volatility of 36.0% per annum. We assume the stock's stochastic process is a geometric Brownian motion (GBM) with a consequent lognormal price distribution. What is the 95.0% confidence interval for the stock price in three months (today + 0.25 years), if we are careful to use the geometric return, which erodes the drift by one-half the variance (i.e., the geometric return is necessarily less than the arithmetic return for any nonzero volatility)?

a. $29.54 < S(0.25) < $121.13

b. $37.24 < S(0.25) < $75.40

c. $45.33 < S(0.25) < $67.18

d. $49.60 < S(0.25) < $60.22

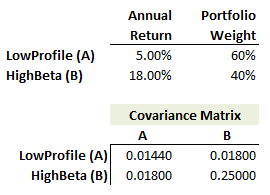

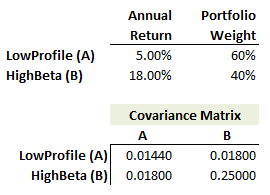

9. A portfolio holds two securities, LowProfile(A) and HighBeta(B). The expected annual returns, weights, and covariance matrix are given by the following:

The security returns are normally distributed and independent over time (i.e., zero autocorrelation). If the portfolio value is $10.0 million and we assume 250 trading days per year, which is nearest to the 10-day 99.0% relative portfolio value at risk (VaR)?

a. $323,700

b. $716,490

c. $1,080,000

d. $3,065,250

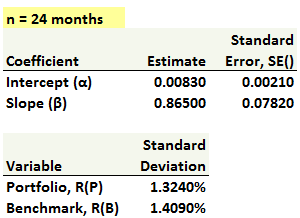

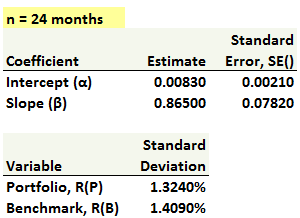

10. A portfolio manager regressed two years of monthly excess portfolio returns, R(P), against the excess returns of the index benchmark, R(B). The sample includes 24 months, n =24. The resulting regression, see below, is R(P,i) = 0.00830 + 0.86500*R(B,i) + e(i).

The portfolio manager infers the following from the regression results:

I. The intercept is significantly different than zero with 95% confidence

II. The slope is significantly different than 1.0 with 95% confidence

III. Assuming the total sum of squares (TSS) is 0.00420, the standard error of the regression (SER) is ~ 1.1940

IV. The coefficient of determination (R^2) is ~ 0.8474

Which of the statements is (are) correct?

a. None

b. I. and IV. only

c. II. and III. only

d. All are correct

Answers:

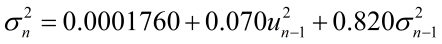

6. The following parameters have been estimated for a GARCH(1,1) model which gives an estimate of today's daily volatility (today = day n):

Yesterday's (n-1) daily volatility was 2.0% and yesterday's daily return was -7.0%. What is the GARCH(1,1) estimate of the daily volatility in 20 days (that is, the estimated volatility on day n+20)?

a. 1.50%

b. 2.85%

c. 3.91%

d. 4.23%

7. Let B and Y represent random normal variables: B ~ N(300, 200^2) and Y ~ N(200,150^2). Let A characterize the average of a random sample of 100 draws (trials) from B, and let X characterize the average of a random sample of 100 draws from Y. We can assume that A and X are independent. What is the joint probability Pr[ A < 253.40, X < 170.60]?

a. 0.050%

b. 0.225%

c. 0.667%

d. 1.305%

8. A stock has a price today of $52.00, an expected return of 14.0% per annum and a volatility of 36.0% per annum. We assume the stock's stochastic process is a geometric Brownian motion (GBM) with a consequent lognormal price distribution. What is the 95.0% confidence interval for the stock price in three months (today + 0.25 years), if we are careful to use the geometric return, which erodes the drift by one-half the variance (i.e., the geometric return is necessarily less than the arithmetic return for any nonzero volatility)?

a. $29.54 < S(0.25) < $121.13

b. $37.24 < S(0.25) < $75.40

c. $45.33 < S(0.25) < $67.18

d. $49.60 < S(0.25) < $60.22

9. A portfolio holds two securities, LowProfile(A) and HighBeta(B). The expected annual returns, weights, and covariance matrix are given by the following:

The security returns are normally distributed and independent over time (i.e., zero autocorrelation). If the portfolio value is $10.0 million and we assume 250 trading days per year, which is nearest to the 10-day 99.0% relative portfolio value at risk (VaR)?

a. $323,700

b. $716,490

c. $1,080,000

d. $3,065,250

10. A portfolio manager regressed two years of monthly excess portfolio returns, R(P), against the excess returns of the index benchmark, R(B). The sample includes 24 months, n =24. The resulting regression, see below, is R(P,i) = 0.00830 + 0.86500*R(B,i) + e(i).

The portfolio manager infers the following from the regression results:

I. The intercept is significantly different than zero with 95% confidence

II. The slope is significantly different than 1.0 with 95% confidence

III. Assuming the total sum of squares (TSS) is 0.00420, the standard error of the regression (SER) is ~ 1.1940

IV. The coefficient of determination (R^2) is ~ 0.8474

Which of the statements is (are) correct?

a. None

b. I. and IV. only

c. II. and III. only

d. All are correct

Answers: