You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exam Feedback May 2019 Part 1 Exam Feedback

- Thread starter Nicole Seaman

- Start date

-

- Tags

- exam-feedback

There was a very short question about normal distribution ,, mean and stad deviation given and asked to calculate mean return...I knew it is a very simple question but i couldn't solve it... anyone has idea?

I remember this question too. Didn't know how to answer it either.

Wasn't the mean reverting question about parameter of AR process phi to be mean reverting , which can be considered as covariance stationary with mod of phi < 1 . I thought if phi is a positive > 1 or negative < 1 the n+1 will keep on diverging and will not be mean reverting.

protective put caps your gains since you own the stick and buy a put. I selected bull spread with calls. but that also caps your gains too. I i didn't think any of the answers would yield unlimited gains though.

Mean-reverting is B < 1

Does more social security schema mean you have a higher probability of country-risk default? I'm not sure i put that as an answer.

For the # of contracts to hedge a position, there was one with the cheapest to deliver figure. I thought that was tricky. I ended up divding by the CTD # and it gave me an answer that matched. Not sure if that's correct tho.

Wasn't the mean reverting question about parameter of AR process phi to be mean reverting , which can be considered as covariance stationary with mod of phi < 1 . I thought if phi is a positive > 1 or negative < 1 the n+1 will keep on diverging and will not be mean reverting.

I'm not sure. But I think it was just asking what does the value have to be in order to be mean-reverting / stationary. I just said b < 1. Didn't think too much into it.

Does anyone know when the results date will be?

I'm not sure. But I think it was just asking what does the value have to be in order to be mean-reverting / stationary. I just said b < 1. Didn't think too much into it.

Does anyone know when the results date will be?

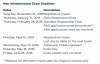

June 28, but apparently there are "tricks" which worked historically to see your result 1 day before, ~June 27, but none of the methods are officially confirmed.

Source: https://www.garp.org/#!/frm/frequently-asked-questions

Wasn't the mean reverting question about parameter of AR process phi to be mean reverting , which can be considered as covariance stationary with mod of phi < 1 . I thought if phi is a positive > 1 or negative < 1 the n+1 will keep on diverging and will not be mean reverting.

You are correct. Essentially it boils down to the expectation which involves the formula of an infinite geometric series, and an infinite geometric series sum(k=0 to inf) a*r^k only converges for |r| < 1.

June 28, but apparently there are "tricks" which worked historically to see your result 1 day before, ~June 27, but none of the methods are officially confirmed.

Source: https://www.garp.org/#!/frm/frequently-asked-questions

View attachment 2091

Oh nice. Well maybe not, that's a solid month or so away actually. Although, I am interested in these "tricks"

Oh nice. Well maybe not, that's a solid month or so away actually. Although, I am interested in these "tricks"

If you read last year's feedback thread and go near the end people discussed the tricks to see if you passed or failed (not the actual quartiles of your performance). From my understanding, one involved changing the Windows PC time on your machine to trick GARP website. Another was logging and in seeing if it told you needed to sign up and pass level 2 in 4 years (this apparently doesn't necessarily confirm either away), and it seems GARP also releases the names of people that passed, and this lists somehow gets prematurely leaked or can be guessed by URL and people did name matching (but not being on the list did not mean you failed). I'll just end up waiting till June 28, since these tricks only seem to work in a neighborhood around June 28 anyways.

If you read last year's feedback thread and go near the end people discussed the tricks to see if you passed or failed (not the actual quartiles of your performance). From my understanding, one involved changing the Windows PC time on your machine to trick GARP website. Another was logging and in seeing if it told you needed to sign up and pass level 2 in 4 years (this apparently doesn't necessarily confirm either away), and it seems GARP also releases the names of people that passed, and this lists somehow gets prematurely leaked or can be guessed by URL and people did name matching (but not being on the list did not mean you failed). I'll just end up waiting till June 28, since these tricks only seem to work in a neighborhood around June 28 anyways.

Very interesting. Cool, i'll be on the look-out for this.

I'm going to assume everyone here finished the exam right? I've read in past threads of ppl who didn't finish at all.

Last edited:

Oh nice. Well maybe not, that's a solid month or so away actually. Although, I am interested in these "tricks"

Just so everyone knows, GARP is aware of these "tricks" so they may make sure that this isn't possible again this year.

Did everyone here end up finishing the exam? I had to randomly mark last 10 odd questions at least which I think might make the difference and make me fall short. Is the passing score expected to go as high as 65 at the very least or can I hope to pass around 55-60 as well?

Anyway, at this juncture, it's tough to predict my own damn score. I am pretty sure of getting at least 50 questions right with 100% accuracy.

One more exam question,

There was a question related to risk aggregation and reporting/ basel accord, was the answer something related to "different business lines of the company" ?

and one easy question i guess was:

N(d1) given

delta of put option..

N(d1)-1, right? 1st option i guess.

One question on Hypothesis Testing , t-test.

Was the option C correct? I don't remember what it said.

Anyway, at this juncture, it's tough to predict my own damn score. I am pretty sure of getting at least 50 questions right with 100% accuracy.

One more exam question,

There was a question related to risk aggregation and reporting/ basel accord, was the answer something related to "different business lines of the company" ?

and one easy question i guess was:

N(d1) given

delta of put option..

N(d1)-1, right? 1st option i guess.

One question on Hypothesis Testing , t-test.

Was the option C correct? I don't remember what it said.

Last edited:

issydimadis

New Member

From what I remember on the exam, in no particukar order:

1. Calculating ES

2. Calculating Covariance

3. Understanding convertible and non callable bond

4. Difference between ETF and Otc

5. Put call parity and hedging strategies

6. CAPM equation

7. Pricing a E call, 1 step binomial

8. Bsm model European put Nd1

9. Portfolio hedging strategy, reducing Beta

10. Garp code of conduct

11. Basel recommendation

12. Risk governance

13. Aic/SIC/MSE and penalizing degrees of freedom

14. T statistic confidence interval

15. Computing the delta of a portfolio

16. Calculating IR and Sharpe Ratio

17. Interest rate swaps

18. Calculating currency swap

19. Foreign exchange exposure

20. Bayes thereom

21. Sortino ratio

22. Value of a future spot rate

23. Loss frequency / severity / Poisson / lognormal

24. Binomial probability, bond default

25. Calculating EL

26. Calculating UL

27. Calculating variance of probability

28. Calculating standard deviation & probability

29. VaR delta question

1. Calculating ES

2. Calculating Covariance

3. Understanding convertible and non callable bond

4. Difference between ETF and Otc

5. Put call parity and hedging strategies

6. CAPM equation

7. Pricing a E call, 1 step binomial

8. Bsm model European put Nd1

9. Portfolio hedging strategy, reducing Beta

10. Garp code of conduct

11. Basel recommendation

12. Risk governance

13. Aic/SIC/MSE and penalizing degrees of freedom

14. T statistic confidence interval

15. Computing the delta of a portfolio

16. Calculating IR and Sharpe Ratio

17. Interest rate swaps

18. Calculating currency swap

19. Foreign exchange exposure

20. Bayes thereom

21. Sortino ratio

22. Value of a future spot rate

23. Loss frequency / severity / Poisson / lognormal

24. Binomial probability, bond default

25. Calculating EL

26. Calculating UL

27. Calculating variance of probability

28. Calculating standard deviation & probability

29. VaR delta question

Did everyone here ended up finishing the exam? I had to randomly mark last 10 odd questions at least which I think will make the difference and make me fall short. Is the passing score expected to go as high as 65 at the very least or can I hope to pass around 55-60 as well?

Anyway, at this juncture, it's tough to predict my own damn score. I am pretty sure of getting at least 50 questions right with 100% accuracy.

One more exam question,

There was a question related to risk aggregation and reporting/ basel accord, was the answer something related to "different business lines of the company" ?

and one easy question i guess was:

N(d1) given

delta of put option..

N(d1)-1, right? 1st option i guess.

One question on Hypothesis Testing , t-test.

Was the option C correct? I don't remember what it said.

Was that about like risk capital to different business lines of the company? If so, I think I picked that one too. There were so many risk governance questions on this exam so it was difficult to decipher exactly which question is which.

From what I remember on the exam, in no particukar order:

1. Calculating ES

2. Calculating Covariance

3. Understanding convertible and non callable bond

4. Difference between ETF and Otc

5. Put call parity and hedging strategies

6. CAPM equation

7. Pricing a E call, 1 step binomial

8. Bsm model European put Nd1

9. Portfolio hedging strategy, reducing Beta

10. Garp code of conduct

11. Basel recommendation

12. Risk governance

13. Aic/SIC/MSE and penalizing degrees of freedom

14. T statistic confidence interval

15. Computing the delta of a portfolio

16. Calculating IR and Sharpe Ratio

17. Interest rate swaps

18. Calculating currency swap

19. Foreign exchange exposure

20. Bayes thereom

21. Sortino ratio

22. Value of a future spot rate

23. Loss frequency / severity / Poisson / lognormal

24. Binomial probability, bond default

25. Calculating EL

26. Calculating UL

27. Calculating variance of probability

28. Calculating standard deviation & probability

29. VaR delta question

Yes, this is legit. The Bayes Theorem one threw me for a long one which I ended up skipping and coming back with an educated guess. Same with the Poisson question and if I remember correctly, there was also a question bionomial probability that was like, what's the probability it it be at least 2? Or something like that. This was towards the end of my exam so I was little crunched on time.

The poission one was like saying that expected probability was like 2 in a month. And it asked for the probability of 6 in 2 months. So the expected is 4. I think the answer was 10% or something like that.

Last edited:

rafael_mv3

New Member

Yeah, I know what you're talking about, but the qualitative questions are fuzzy to me since most of my time was spent on quantitative ones. Even though some of them were tricky I do recall them being easier than expected b/c

-They weren't that "wordy". Reading previous exam threads I was prepared to sift through paragraphs of text to get to the point, but I thought they were concise and to the point.

-They asked "which one is correct?" rather than "which one is NOT correct", and I think that is personally easier.

For the specific question you're talking about, I, unfortunately, do not remember the choices or what I put, but it makes you feel any better I vaguely do recall gravitating towards risk capital. I remember only two qualitative questions somewhat well b/c I think I got them wrong.

(1) Asked which is correct related to MBS with choices?

-2 Choices that I think were wrong

-"OAS" being a spread to interest rate paths (but the way it was worded seemed wrong)

-The prepayment option of MBS is attractive when PV of scheduled principal payments is less than the outstanding principal

(2) If you think stock value will double what strategy is best?

-Protective Put

-Covered Call

-Bull spread of call options

-Bear spread of call options (or might have said put options)

(2) The payoff profile of the protective put is similar to a call option. So if the stock price double, the protective put will be the best choice.

- Numerical example:

Strike Low (XL) = $ 23.50

Call Low (CL) = $ 2.50

Put Low (PL) = $ 0.50

Stock Price (S0) = $ 25.50

Strike High (SH) = $ 27.50

Call High (CH) = $ 1.00

Put High (PH) = $ 3.00

2x Stock Price (ST) = $ 51.00.

1) Protective Put (long put low, long Stock - S0):

Profit: max(0, 51 - 25.50) - 0.50 = $ 25.00.

2) Bull Spread (long call low, short call high):

Profit: max(0, 51 - 23.50) - max(0, 51 - 27.50) - 2.50 + 1.00 = $ 2.50.

3) Bear Spread (short call low, long call high):

Profit: max(0, 51 - 27.50) - max(0, 51 - 23.50) + 2.50 - 1.00 = -$ 2.50.

4) Covered Call (long Stock - S0, short call high):

Profit: 27.50 - 25.50 + 1.00 = $ 3.00.

Have realised I made a ton of silly errors by not reading the questions correctly - function of being pressed for time I guess.

To add to the list:

30. Barings bank collateral

31. Wac and wam

32. M'schaft question

33. Portfolio insurance

34. Something about a ccp and its risk - wrong way risk or liquidity?

35. Erm question - can't remember specifics.

To add to the list:

30. Barings bank collateral

31. Wac and wam

32. M'schaft question

33. Portfolio insurance

34. Something about a ccp and its risk - wrong way risk or liquidity?

35. Erm question - can't remember specifics.

Paramveersaini

New Member

It appears convincing with these facts. But not true to spirit of protective put which is to protect from loss. Also in bull spread, you actually write an out of money call - to subsidize call you have bought. What if I write a call with strike of 55. Then bull spread seems convincing....(2) The payoff profile of the protective put is similar to a call option. So if the stock price double, the protective put will be the best choice.

- Numerical example:

Strike Low (XL) = $ 23.50

Call Low (CL) = $ 2.50

Put Low (PL) = $ 0.50

Stock Price (S0) = $ 25.50

Strike High (SH) = $ 27.50

Call High (CH) = $ 1.00

Put High (PH) = $ 3.00

2x Stock Price (ST) = $ 51.00.

1) Protective Put (long put low, long Stock - S0):

Profit: max(0, 51 - 25.50) - 0.50 = $ 25.00.

2) Bull Spread (long call low, short call high):

Profit: max(0, 51 - 23.50) - max(0, 51 - 27.50) - 2.50 + 1.00 = $ 2.50.

3) Bear Spread (short call low, long call high):

Profit: max(0, 51 - 27.50) - max(0, 51 - 23.50) + 2.50 - 1.00 = -$ 2.50.

4) Covered Call (long Stock - S0, short call high):

Profit: 27.50 - 25.50 + 1.00 = $ 3.00.

Similar threads

- Replies

- 2

- Views

- 555

- Replies

- 5

- Views

- 1K

- Replies

- 2

- Views

- 662

- Replies

- 7

- Views

- 2K

- Replies

- 9

- Views

- 2K