saurabhpal49

New Member

hi David,

Could you please explain the below mentioned sentence

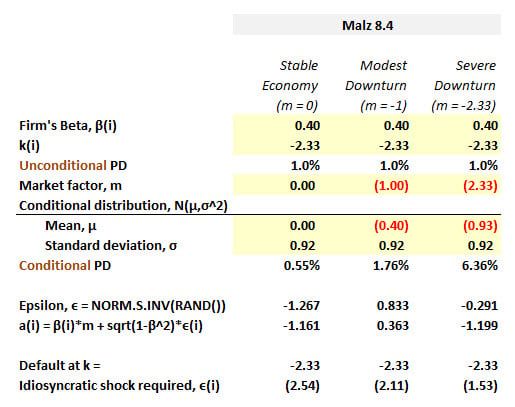

Given m a realization of Ei less than or equal to Ki - Bim triggers default. As we let m vary from high to low values a smaller idisyncratic shock will suffice to trigger default

Could you please explain the below mentioned sentence

Given m a realization of Ei less than or equal to Ki - Bim triggers default. As we let m vary from high to low values a smaller idisyncratic shock will suffice to trigger default