You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

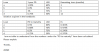

Lowest Credit Risk

- Thread starter Abhijit CMA

- Start date

Hi @abhijitfrm @ShaktiRathore showed the solution for a similar problem here at https://forum.bionicturtle.com/threads/please-solve-these-questions.9942/#post-45738...

e.g.,

Loan A PD to maturity = 1-(1 - 1.99%)^(3/12) = 0.501%

Loan B PD to maturity = 1-(1 - 0.90%)^(9/12) = 0.676%. I hope that helps!

1) For Loan A we need to find 3 month PD ,1-(1-3 month PD)^4=1 year PD =>3 month PD=1-(1-1 year PD)^(1/4)=1-(1-.025)^(1/4)=.00631 =>EL(3mnths)=.00631*50%=.3155%

Loan B: 9 month PD=1-(1-1 year PD)^(.75)=1-(1-.011)^(.75)=.00826=>EL(9mnths)=.00826*65%=.5369%

Loan C: 6 month PD=1-(1-1 year PD)^(.5)=1-(1-.01)^(.5)=.0050=>EL(6 mnths)=.0050*60%=.30%

Loan D: 12 month PD=1-(1-1 year PD)^(1)=1-(1-.0075)^(1)=.0075=>EL(12mnths)=.0075*50%=0.375%

Thus the Loan C has the lowest credit risk with the lowest EL of .30%.

thanks

e.g.,

Loan A PD to maturity = 1-(1 - 1.99%)^(3/12) = 0.501%

Loan B PD to maturity = 1-(1 - 0.90%)^(9/12) = 0.676%. I hope that helps!

Abhijit CMA

New Member

Thanks David...

Similar threads

- Replies

- 0

- Views

- 118

- Replies

- 0

- Views

- 222

- Replies

- 0

- Views

- 118

- Replies

- 0

- Views

- 250