gargi.adhikari

Active Member

In Reference to FIN_PRODS_DIVIDEND_PAYING_CALL_OPTION :-

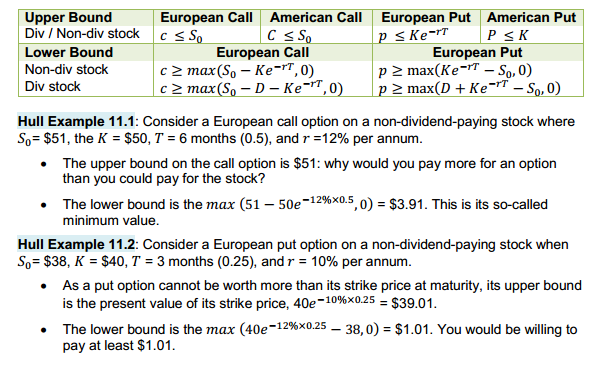

Call Options are Not Exercised Early.

So, Ct = [ St - K. e EXP( -r*T) ] for Both European & American Call Options

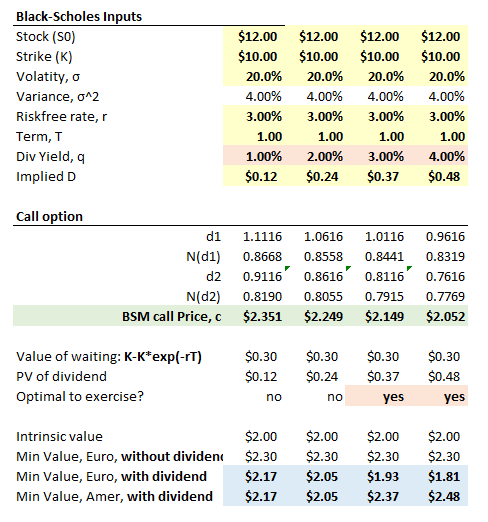

However, Call Options are EXERCISED-EARLY when DIVIDENDS are paid - they are exercised just before the Dividend-Paying-Date. So in the case where Dividends are paid, shouldn't the

( Ct = St - K ) for American Call Options...?

Much gratitude for insights on this

Call Options are Not Exercised Early.

So, Ct = [ St - K. e EXP( -r*T) ] for Both European & American Call Options

However, Call Options are EXERCISED-EARLY when DIVIDENDS are paid - they are exercised just before the Dividend-Paying-Date. So in the case where Dividends are paid, shouldn't the

( Ct = St - K ) for American Call Options...?

Much gratitude for insights on this

as i went out on this exploration limb!

as i went out on this exploration limb!