rahul.goyl

Member

Hi david,

Could you plz explain what a Lookback straddle has to do with fixed income convergence.

I cannot link the two. Need your help asap.

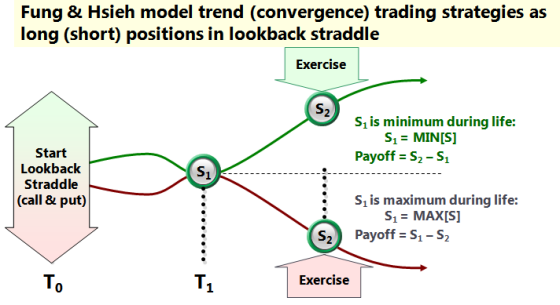

The payoff of some hedge fund strategies is commonly identified with the payoff of option strategies.

The payoff of a long look-back straddle correspond best to the payoff of

a. A trend following strategy.

b. A fixed-income arbitrage strategy.

c. A fixed-income convergence strategy.

d. A spread trading strategy.

Answer: c

Thanks

Rahul

Could you plz explain what a Lookback straddle has to do with fixed income convergence.

I cannot link the two. Need your help asap.

The payoff of some hedge fund strategies is commonly identified with the payoff of option strategies.

The payoff of a long look-back straddle correspond best to the payoff of

a. A trend following strategy.

b. A fixed-income arbitrage strategy.

c. A fixed-income convergence strategy.

d. A spread trading strategy.

Answer: c

Thanks

Rahul