ChristofferLoov

New Member

Hi David,

I’m trying to wrap my head around key rates and therefore have a few questions. I tried searching the forum but couldn’t find the answer.

I’m trying to wrap my head around key rates and therefore have a few questions. I tried searching the forum but couldn’t find the answer.

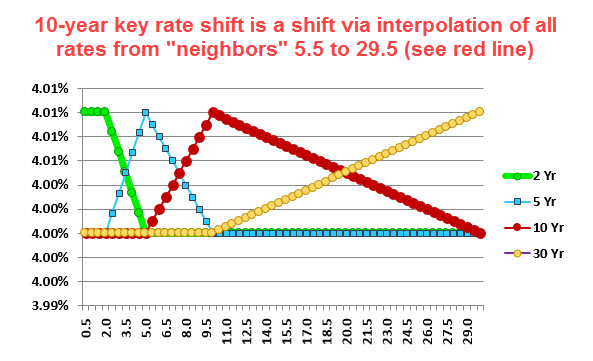

- In Tuckmans example all securities seems to have the same maturity as a key rate, but one point of key rates were to keep them as few as possible for hedging purposes. What happens if I have a zero coupon bond with a maturity of 14 years but my closest key rates are for 10 and 30 years? Do I use linear interpolation to distribute the cash flows to those key rates?

- Tuckman says that we select the most liquid government securities to calculate the key rates. However in his example he calculates different key rate 01 and durations for each bond in the portfolio. If we select government securities as a benchmark, shouldn’t the key rate 01 and duration for all bonds in the portfolio be the same? Or is it the case that since we have 4 key rates in the example, the shortest maturity will have 4 KR01, the next will have 3 KR01 and so on?

- If that is not the case how does that impact the number of simultaneous equations we have to solve to hedge the exposure?