Hi David,

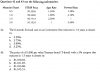

could you please check whether one can solve the question 43 using the PV-function in the calculator? Here is the question:

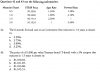

I get an answer 1,011.74 when I use my calculator. Do I made a mistake? I calculate so: N=3; I/Y=2.2/2=1.1; PMT=15; FV=1,000 -> CPT PV = 1,011.74. Here is the right answer:

Is the way I'm solving it wrong??

Thank you very much and best regards!

could you please check whether one can solve the question 43 using the PV-function in the calculator? Here is the question:

I get an answer 1,011.74 when I use my calculator. Do I made a mistake? I calculate so: N=3; I/Y=2.2/2=1.1; PMT=15; FV=1,000 -> CPT PV = 1,011.74. Here is the right answer:

Is the way I'm solving it wrong??

Thank you very much and best regards!