sunithamenon

New Member

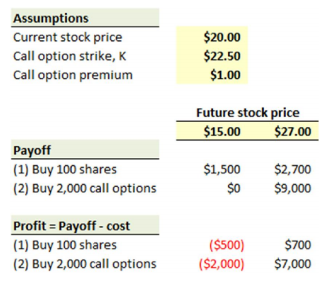

I was going through the example mentioned under the heading ' Calculate and compare the payoffs from hedging strategies involving forward contracts and options' (T3-FMP-4-Ch4-Derivatives). I did not understand the values highlighted in green below mentioned in the example on the study material.

Each option contract would cost 100 * $1.00 = $100.00 and the total cost of the hedging

strategy would be 10 *$100.00 = $1,000.00.

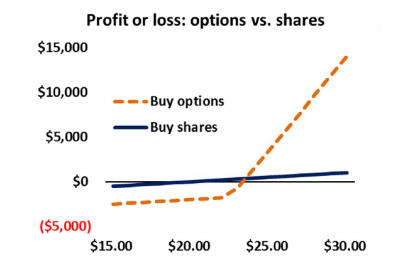

And also the example mentioned in 'Speculations using Options' mentioned under the heading 'Calculate and compare the payoffs from speculative strategies

involving futures and options.'

Would you please help me understand this?

Each option contract would cost 100 * $1.00 = $100.00 and the total cost of the hedging

strategy would be 10 *$100.00 = $1,000.00.

And also the example mentioned in 'Speculations using Options' mentioned under the heading 'Calculate and compare the payoffs from speculative strategies

involving futures and options.'

Would you please help me understand this?