Steve Jobs

Active Member

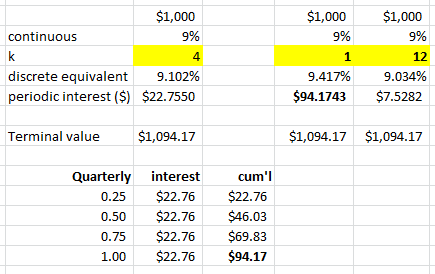

Assume the following:

An asset is quoted at 12% annually with continuous rate.

Interest is paid quarterly.

Is this correct for equivalent rate with monthly compounding?

r = 12 * [ e^(.12/12)) - 1] = 12.06%

Does it matter whether interest is paid quarterly, monthly or annually? What about doing the reverse convert from continuous to discrete?

An asset is quoted at 12% annually with continuous rate.

Interest is paid quarterly.

Is this correct for equivalent rate with monthly compounding?

r = 12 * [ e^(.12/12)) - 1] = 12.06%

Does it matter whether interest is paid quarterly, monthly or annually? What about doing the reverse convert from continuous to discrete?