You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Implication of mean reversion in returns and return volatility

- Thread starter ajsa

- Start date

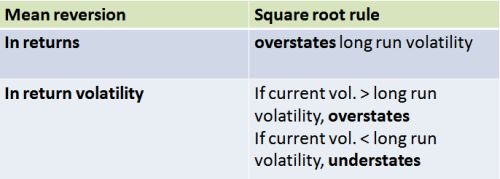

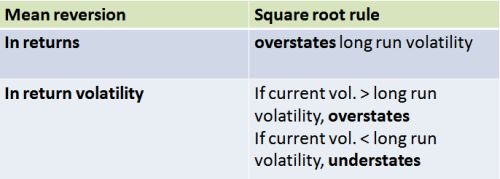

The key takeaways are on slide p 40 of 4a Valuation tutorial

in regard to first mean reversion, learning XLS shows this in action:

https://www.dropbox.com/s/jg4fdfs5sk41h55/4_a_1_2assetvar_v1.xls?dl=0

if you change the auto (serial) correlation to negative, then you are simulating mean reversion in returns; the point is that this AR(1) VaR (i.e., negative serial correlation in returns) gives a lower value that regular scaled VaR...that is, square root rule overstates (understates) mean reversion (positive serial correlation)

in regard to second, think of mean reversion term in GARCH(1,1) where the issue is "is my current vol above or below the long term vol" b/c it will fade to that...

...so the first idea here is that we have two different meaning of mean reversion (there are more!) so you gotta first see the difference between them.

David

in regard to first mean reversion, learning XLS shows this in action:

https://www.dropbox.com/s/jg4fdfs5sk41h55/4_a_1_2assetvar_v1.xls?dl=0

if you change the auto (serial) correlation to negative, then you are simulating mean reversion in returns; the point is that this AR(1) VaR (i.e., negative serial correlation in returns) gives a lower value that regular scaled VaR...that is, square root rule overstates (understates) mean reversion (positive serial correlation)

in regard to second, think of mean reversion term in GARCH(1,1) where the issue is "is my current vol above or below the long term vol" b/c it will fade to that...

...so the first idea here is that we have two different meaning of mean reversion (there are more!) so you gotta first see the difference between them.

David

Last edited:

...sorry above it cutoff on right...don't know why it's doing that...I'll ask Shawn to look at (i think it's a nonnormal character but i can't find it...)...David

append: okay, we figured that out: your original title was too long for the forum (apparently). We truncated your title....thanks, David

append: okay, we figured that out: your original title was too long for the forum (apparently). We truncated your title....thanks, David

Hi asja, what is ND (sorry)? RiskMetrics is EWMA...David

duh Dave

the GARCH we study is technically symmetric normal GARCH(1,1) ...

GARCH is chess, EMWA is checkers, if you know what i mean...

GARCH is very flexible ...

In our SN GARCH(1,1), where i.i.d. normality is the assumption, the key point (IMO) is:

returns are conditionally normal, and

unconditionally heavy-tailed (non-normal)

...often-times you will read "does GARCH model heavy-tails?" where the answer is (imprecisely maybe) given as "Yes." And we wonder, but it assumes normality? And the explain is: unconditional non-normality (b/c GARCH is really a *mixture* of normals, which will always give kurtosis > 3).

...there are other flavors of GARCH, btw. do not need to assume normality

for more depth, the best (IMO) is Carol Alexander Vol II or Stephen Taylor's Asset Price Dynamics...David

the GARCH we study is technically symmetric normal GARCH(1,1) ...

GARCH is chess, EMWA is checkers, if you know what i mean...

GARCH is very flexible ...

In our SN GARCH(1,1), where i.i.d. normality is the assumption, the key point (IMO) is:

returns are conditionally normal, and

unconditionally heavy-tailed (non-normal)

...often-times you will read "does GARCH model heavy-tails?" where the answer is (imprecisely maybe) given as "Yes." And we wonder, but it assumes normality? And the explain is: unconditional non-normality (b/c GARCH is really a *mixture* of normals, which will always give kurtosis > 3).

...there are other flavors of GARCH, btw. do not need to assume normality

for more depth, the best (IMO) is Carol Alexander Vol II or Stephen Taylor's Asset Price Dynamics...David

asja ... if you had used N() or N(.) I would have known what you meant

ND made me think of non-disclosure...useless trivia...David

ND made me think of non-disclosure...useless trivia...David

Hi asja,

My point above--returns conditionally normal, unconditionally non-normal--was about GARCH(1,1). RM = version[EWMA].

RiskMetrics only assumes conditionally normal, right? The assignments say yes, but I'm not current in RM and I'm afraid to assert that wholesale (EWMA is a merely weighting scheme, other distributions could conceivablly be introduced...i don't know their current system)

btw, conditional mean/vol is consistent with conditional normal, right? Yes, i think so, though I have trouble interpreting this ... note the 'CH' in GARCH refers to conditional heteroskdasticity (i.e., time varying conditional variance)

David

My point above--returns conditionally normal, unconditionally non-normal--was about GARCH(1,1). RM = version[EWMA].

RiskMetrics only assumes conditionally normal, right? The assignments say yes, but I'm not current in RM and I'm afraid to assert that wholesale (EWMA is a merely weighting scheme, other distributions could conceivablly be introduced...i don't know their current system)

btw, conditional mean/vol is consistent with conditional normal, right? Yes, i think so, though I have trouble interpreting this ... note the 'CH' in GARCH refers to conditional heteroskdasticity (i.e., time varying conditional variance)

David

Hi asja,

The normality (1) is okay for SRR; but (2) is a problem.

But even without the mean reversion, SRR cannot apply to GARCH. The key requirement is i.i.d. (independent & identically distributed) ... the "conditional heteroskedasticity' (the "CH" in GARCH) is contrary to the "identical" in the i.i.d. requirement

... put another way SRR requires i.i.d. which presumes constant volatility (like we see in GBM Black-Scholes)

...the SRR requirement of i.i.d. is, in practice, very limiting - violated by mean reversion, violated by autocorrelation, violated by non-costant volatility ... pretty much, when we do it, we commit a error !

David

The normality (1) is okay for SRR; but (2) is a problem.

But even without the mean reversion, SRR cannot apply to GARCH. The key requirement is i.i.d. (independent & identically distributed) ... the "conditional heteroskedasticity' (the "CH" in GARCH) is contrary to the "identical" in the i.i.d. requirement

... put another way SRR requires i.i.d. which presumes constant volatility (like we see in GBM Black-Scholes)

...the SRR requirement of i.i.d. is, in practice, very limiting - violated by mean reversion, violated by autocorrelation, violated by non-costant volatility ... pretty much, when we do it, we commit a error !

David

Hi David,

Sorry for keep getting confused..

1. is the residual term same as variance?

2. The autocorrelation means that returns correlate to each other, or residual terms correlate to each other? Or you mean the term of 'autocorrelation' can apply to both return and error term? I am asking also because I think serial correlation means residual terms correlate to each other, but I thought serial correlation is same as autocorrelation? But I also think the autocorrelation on *returns* violate the SRR

3. Is mean reversion on variance a kind of autocorrelation? autocorrelation on variance?

Thank you!

Sorry for keep getting confused..

1. is the residual term same as variance?

2. The autocorrelation means that returns correlate to each other, or residual terms correlate to each other? Or you mean the term of 'autocorrelation' can apply to both return and error term? I am asking also because I think serial correlation means residual terms correlate to each other, but I thought serial correlation is same as autocorrelation? But I also think the autocorrelation on *returns* violate the SRR

3. Is mean reversion on variance a kind of autocorrelation? autocorrelation on variance?

Thank you!

Hi ajsa,

Hull's GARCH(1,1) = omega + alpha*lagged squared return^2 + beta*lagged variance

1. The residuals contribute to series variance but are not the variance.

alpha*lagged squared return^2, where Hull simplified from (see 21.2 formula on simplification note)

alpha * (return - mean return)^2; such that residual = return - mean return;

If mean return =0, residual = return...variance is the average of a series of squared returns, or we could say, the 1-day variance is return^2

2. This is tricky ... recommend be careful about losing sight of bigger picture...technically:

the correlation between returns is zero (i.e., in GARCH, conditional residuals are i.i.d.) but the correlation between squared residuals: (return - mean return)^2 ... is positive...but IMO this will not make sense without the prior foundation

Re: ‘autocorrelation’ can apply to both return and error term? I am asking also because I think serial correlation means residual terms correlate to each other, but I thought serial correlation is same as autocorrelation?

Auto (serial) correlation can refer to any sequence of variables (as seen here in GARCH, we can technically refer to different variables over time)...

IMO, what you said is the best way to think about: "serial correlation means residual terms"

...that is informed by Gujarati's *regression* where a key assumption in the CLRM is no autocorrelation; i.e., no correlation between the disturbances (residuals are just the estimators of disturbances)...so (IMO) this is your most useful definition

Re: but I thought serial correlation is same as autocorrelation? To my knowledge, they are the same, the confusion arises b/c we can be referencing different variables

Re: But I also think the autocorrelation on *returns* violate the SRR

Yes, it would voilate SSR per linda allen's points b/c it would violate the "indendendence" in i.i.d.

...but it's violation in GARCH is more complex and that is why i leaned above on the constant volatility (the "identical" in i.i.d.) to avoid the issue

3. Re: Is mean reversion on variance a kind of autocorrelation? autocorrelation on variance?

IMO (i am not just throwing IMO out there to be humble, it typically means: I haven't confirmed with research), yes, that is a valid idea.

Specifcally, the mean reversion term (the omega, not the other terms) in GARCH might be viewed as *negative* auto-/serial correlation in the variance; i.e. ,if current variance estimate is high, next will be lower to gravitate toward the LR variance

...however, that is mostly b/c of the unfortunate reality that "mean reversion" has several definitions...most of them are negative autocorrelation but the issue is (i) time frame and (ii) which variable

See http://www.bionicturtle.com/learn/article/what_is_mean_reversion_in_financial_time_series/

David

Hull's GARCH(1,1) = omega + alpha*lagged squared return^2 + beta*lagged variance

1. The residuals contribute to series variance but are not the variance.

alpha*lagged squared return^2, where Hull simplified from (see 21.2 formula on simplification note)

alpha * (return - mean return)^2; such that residual = return - mean return;

If mean return =0, residual = return...variance is the average of a series of squared returns, or we could say, the 1-day variance is return^2

2. This is tricky ... recommend be careful about losing sight of bigger picture...technically:

the correlation between returns is zero (i.e., in GARCH, conditional residuals are i.i.d.) but the correlation between squared residuals: (return - mean return)^2 ... is positive...but IMO this will not make sense without the prior foundation

Re: ‘autocorrelation’ can apply to both return and error term? I am asking also because I think serial correlation means residual terms correlate to each other, but I thought serial correlation is same as autocorrelation?

Auto (serial) correlation can refer to any sequence of variables (as seen here in GARCH, we can technically refer to different variables over time)...

IMO, what you said is the best way to think about: "serial correlation means residual terms"

...that is informed by Gujarati's *regression* where a key assumption in the CLRM is no autocorrelation; i.e., no correlation between the disturbances (residuals are just the estimators of disturbances)...so (IMO) this is your most useful definition

Re: but I thought serial correlation is same as autocorrelation? To my knowledge, they are the same, the confusion arises b/c we can be referencing different variables

Re: But I also think the autocorrelation on *returns* violate the SRR

Yes, it would voilate SSR per linda allen's points b/c it would violate the "indendendence" in i.i.d.

...but it's violation in GARCH is more complex and that is why i leaned above on the constant volatility (the "identical" in i.i.d.) to avoid the issue

3. Re: Is mean reversion on variance a kind of autocorrelation? autocorrelation on variance?

IMO (i am not just throwing IMO out there to be humble, it typically means: I haven't confirmed with research), yes, that is a valid idea.

Specifcally, the mean reversion term (the omega, not the other terms) in GARCH might be viewed as *negative* auto-/serial correlation in the variance; i.e. ,if current variance estimate is high, next will be lower to gravitate toward the LR variance

...however, that is mostly b/c of the unfortunate reality that "mean reversion" has several definitions...most of them are negative autocorrelation but the issue is (i) time frame and (ii) which variable

See http://www.bionicturtle.com/learn/article/what_is_mean_reversion_in_financial_time_series/

David

Hi David,

Thank you so much!

Actually, maybe I did not put it very clear, and I am not sure if it makes any difference. When I was asking these 3 questions, I was thinking about regression. I am not sure thinking about GARCH here is more general or more specific?

So talking about regression in general, the autocorrelation is on return or on residual term? SRR makes me feel it is on return (so cannot do SRR), but serial correlation definition makes me feel it is on residual term.. Sorry for being a pain...

Thanks again!

Thank you so much!

Actually, maybe I did not put it very clear, and I am not sure if it makes any difference. When I was asking these 3 questions, I was thinking about regression. I am not sure thinking about GARCH here is more general or more specific?

So talking about regression in general, the autocorrelation is on return or on residual term? SRR makes me feel it is on return (so cannot do SRR), but serial correlation definition makes me feel it is on residual term.. Sorry for being a pain...

Thanks again!

...oh, LOL...if SRR refers to square root rule, I associated that we scaling volatilty (and therefore VaR) over time ...

In regard to regression, the "no autocorrelation" assumption of CLRM refers to lack of autocorelation in the disturbances/residuals (regression is general, the variables could be returns or not)...David

In regard to regression, the "no autocorrelation" assumption of CLRM refers to lack of autocorelation in the disturbances/residuals (regression is general, the variables could be returns or not)...David

yes exactly ...

Re: SSR, it might be worth looking at: http://www.bionicturtle.com/premium/spreadsheet/4.a.1_two_asset_var_relative_vs_absolute/

that's 2 asset VaR with square root rule scaling but if you change autocorrlation to nonzero, it violates and requires adjustment

the autocorrelation there is, as labelled, between returns

and re regresssion, correct, per CLRM: cov(error, error) = 0

David

Re: SSR, it might be worth looking at: http://www.bionicturtle.com/premium/spreadsheet/4.a.1_two_asset_var_relative_vs_absolute/

that's 2 asset VaR with square root rule scaling but if you change autocorrlation to nonzero, it violates and requires adjustment

the autocorrelation there is, as labelled, between returns

and re regresssion, correct, per CLRM: cov(error, error) = 0

David

Hi ajsa,

The AR(1) process that Linda Allen briefy reviews (i.e., X(n) = a +bx(n-1)+ e) is "autoregressive" because the X(n) is a (linear) function of X(n-1).

GARCH has this feature, GARCH is autogressive ("AR" in GARCH) because the variance estimate is (largely) a linear function of the previous variance (i.e., X = variance in GARCH).

It is true that some, including Linda Allen, call this "mean reversion;" because it's different than the mean reversion term, I do not like this usage (i.e., mean reversion has two different meanings, and alas, up to 5 or 6 in total). So we have two different ideas in GARCH:

1. beta*lag variance: this is the AR() autogressive aspect which, btw, reminds us that variances are autocorrelated in GARCH but returns are not; i.e., X(n) = a +b*X(n-1) ensures that X is not independent from step to step!

2. omega = gamma * LR variance: this is the "true" mean reversion component; i.e., the variance is gravitationally attracted to this LR Variance

I prefer to think of (1) as the component that captures "volatility is sticky" (i.e., high variance likely to be followed by high variance) and (2) as the "mean reversion"

Thanks, David

The AR(1) process that Linda Allen briefy reviews (i.e., X(n) = a +bx(n-1)+ e) is "autoregressive" because the X(n) is a (linear) function of X(n-1).

GARCH has this feature, GARCH is autogressive ("AR" in GARCH) because the variance estimate is (largely) a linear function of the previous variance (i.e., X = variance in GARCH).

It is true that some, including Linda Allen, call this "mean reversion;" because it's different than the mean reversion term, I do not like this usage (i.e., mean reversion has two different meanings, and alas, up to 5 or 6 in total). So we have two different ideas in GARCH:

1. beta*lag variance: this is the AR() autogressive aspect which, btw, reminds us that variances are autocorrelated in GARCH but returns are not; i.e., X(n) = a +b*X(n-1) ensures that X is not independent from step to step!

2. omega = gamma * LR variance: this is the "true" mean reversion component; i.e., the variance is gravitationally attracted to this LR Variance

I prefer to think of (1) as the component that captures "volatility is sticky" (i.e., high variance likely to be followed by high variance) and (2) as the "mean reversion"

Thanks, David

Similar threads

- Replies

- 0

- Views

- 510

- Replies

- 0

- Views

- 120

- Replies

- 0

- Views

- 414

- Replies

- 0

- Views

- 134