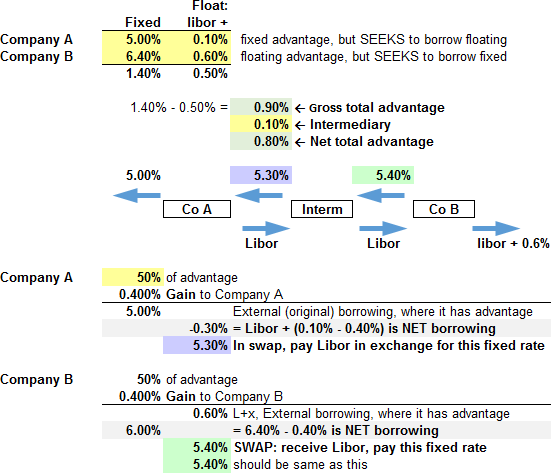

Q. "Companies A and B have been offered the following rates per annum on a $20 million five-year loan: Fixed Rate Company A Floating Rate 5.0% Company B LIBOR+0.1% 6.4% LIBOR+0.6% Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies. "

As per the solution company A receives 5.3 %..... But I got the answer as 5.4%

I think that and here is 5.3% because 0.1% margin of the bank. But didn't we already subtracted it from difference of differentials of two rates to get the net profit for each?

I.e. 1.4 - 0.5 - 0.1%=0.8% divided by 2. So y are we again subtracting 0.1% from interest payment to company A???

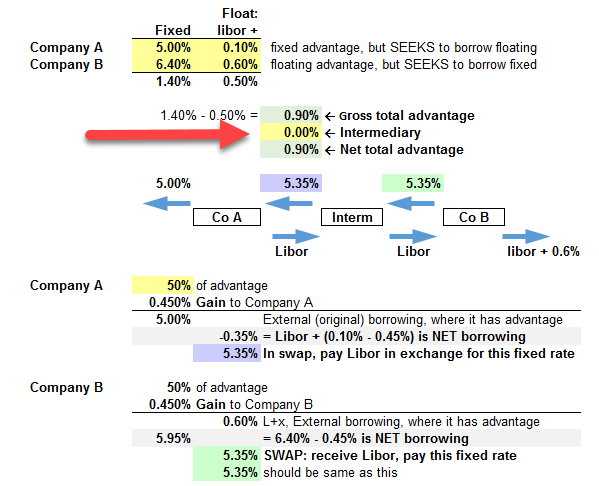

As per the solution company A receives 5.3 %..... But I got the answer as 5.4%

I think that and here is 5.3% because 0.1% margin of the bank. But didn't we already subtracted it from difference of differentials of two rates to get the net profit for each?

I.e. 1.4 - 0.5 - 0.1%=0.8% divided by 2. So y are we again subtracting 0.1% from interest payment to company A???

); the XLS is here

); the XLS is here