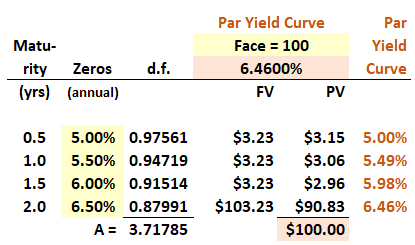

Question 16.16: The six-month, 12-month, 18-month, and 24-month zero rates are 5%, 5.5%, 6%, and 6.5% (all measured with semi-annual compounding) respectively. What is the two-year par yield for a bond paying coupons every six months?

For the par yield, I keep getting 6.41%, and A= 3.7465. Slightly different from the answers in the book.

Is this a mistake, or have I done something incorrect?

For the par yield, I keep getting 6.41%, and A= 3.7465. Slightly different from the answers in the book.

Is this a mistake, or have I done something incorrect?

Last edited by a moderator: