Hi there,

I just wanted to see if I could ask one of the questions from a past Practice exam (2017). Here is the question:

Note: Updated by Nicole to copy/paste text of question for search purposes

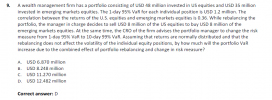

A wealth management firm has a portfolio consisting of USD 48 million invested in US equities and USD 35 million invested in emerging markets equities. The 1-day 95% VaR for each individual position is USD 1.2 million. The correlation between the returns of the U.S. equities and emerging markets equities is 0.36. While rebalancing the portfolio, the manager in charge decides to sell USD 8 million of the US equities to buy USD 8 million of the emerging markets equities. At the same time, the CRO of the firm advises the portfolio manager to change the risk measure from 1-day 95% VaR to 10-day 99% VaR. Assuming that returns are normally distributed and that the rebalancing does not affect the volatility of the individual equity positions, by how much will the portfolio VaR increase due to the combined effect of portfolio rebalancing and change in risk measure?

A. USD 6.870 million

B. USD 8.248 million

C. USD 11.270 million

D. USD 12.482 million

And here is their solution:

The solution makes sense, but I was wondering why the following does not work:

New US Equity VaR = 1.2 * (40/48) * (2.33/1.645) * sqrt(10) = 4.47

New Emerging Market Equity VaR = 1.2 * (43/35) * (2.33/1.645) * sqrt(10) = 6.603

New Total VaR = sqrt(4.47^2 + 6.603^2 + 2*0.36*4.47*6.603) = 9.217

[Please let me know if I am allowed to post questions of past practice exams -- happy to remove it if it is a problem]

[Also I could not find this question asked anywhere on the forum -- if it has been asked, could you please send me the link to that forum please ]

]

Thanks!

I just wanted to see if I could ask one of the questions from a past Practice exam (2017). Here is the question:

Note: Updated by Nicole to copy/paste text of question for search purposes

A wealth management firm has a portfolio consisting of USD 48 million invested in US equities and USD 35 million invested in emerging markets equities. The 1-day 95% VaR for each individual position is USD 1.2 million. The correlation between the returns of the U.S. equities and emerging markets equities is 0.36. While rebalancing the portfolio, the manager in charge decides to sell USD 8 million of the US equities to buy USD 8 million of the emerging markets equities. At the same time, the CRO of the firm advises the portfolio manager to change the risk measure from 1-day 95% VaR to 10-day 99% VaR. Assuming that returns are normally distributed and that the rebalancing does not affect the volatility of the individual equity positions, by how much will the portfolio VaR increase due to the combined effect of portfolio rebalancing and change in risk measure?

A. USD 6.870 million

B. USD 8.248 million

C. USD 11.270 million

D. USD 12.482 million

And here is their solution:

The solution makes sense, but I was wondering why the following does not work:

New US Equity VaR = 1.2 * (40/48) * (2.33/1.645) * sqrt(10) = 4.47

New Emerging Market Equity VaR = 1.2 * (43/35) * (2.33/1.645) * sqrt(10) = 6.603

New Total VaR = sqrt(4.47^2 + 6.603^2 + 2*0.36*4.47*6.603) = 9.217

[Please let me know if I am allowed to post questions of past practice exams -- happy to remove it if it is a problem]

[Also I could not find this question asked anywhere on the forum -- if it has been asked, could you please send me the link to that forum please

]

]Thanks!

Attachments

Last edited by a moderator: