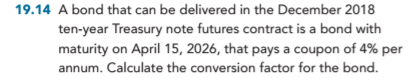

Hi Dave,

Do you get the same result as the book for question 19.14?

My initial bond price calculation (14 coupon periods, semiannual yield of 3%, coupon = 2) gives a price of 88.7039. Then discounted by three months to 87.4026.

The book has something different. Have I missed something here?

Do you get the same result as the book for question 19.14?

My initial bond price calculation (14 coupon periods, semiannual yield of 3%, coupon = 2) gives a price of 88.7039. Then discounted by three months to 87.4026.

The book has something different. Have I missed something here?

Thank you.

Thank you.