Mohamed.FRM

New Member

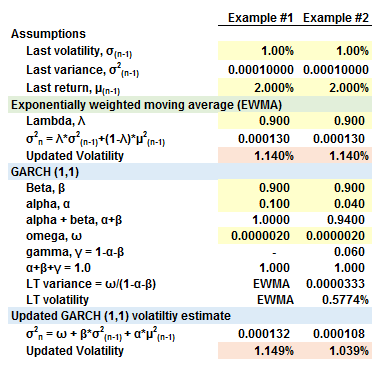

1- for FRM exam purpose, what is the required information to be memorized regarding GARCH equation?

2- Could you please provide Detailed explanation/answer for the following question?

Consider the following four GARCH equations:

Equation 1: σ2n = 0.83 + 0.05μ2n-1 + 0.93σ2n-1

Equation 2: σ2n = 0.06 + 0.04μ2n-1 + 0.95σ2n-1

Equation 3: σ2n = 0.60 + 0.10μ2n-1 + 0.94σ2n-1

Equation 4: σ2n = 0.03 + 0.03μ2n-1 + 0.93σ2n-1

Which of the following statements regarding these equations is (are) CORRECT?

2- Could you please provide Detailed explanation/answer for the following question?

Consider the following four GARCH equations:

Equation 1: σ2n = 0.83 + 0.05μ2n-1 + 0.93σ2n-1

Equation 2: σ2n = 0.06 + 0.04μ2n-1 + 0.95σ2n-1

Equation 3: σ2n = 0.60 + 0.10μ2n-1 + 0.94σ2n-1

Equation 4: σ2n = 0.03 + 0.03μ2n-1 + 0.93σ2n-1

Which of the following statements regarding these equations is (are) CORRECT?

I.Equation 1 is a stationary model.

II.Equation 2 shows no mean reversion

III.Volatility will revert to a long run mean level faster with Equation 1 than it will for Equation 4.

IV.Volatility will revert to a long run mean level faster with Equation 3 than it will for Equation 2.

II.Equation 2 shows no mean reversion

III.Volatility will revert to a long run mean level faster with Equation 1 than it will for Equation 4.

IV.Volatility will revert to a long run mean level faster with Equation 3 than it will for Equation 2.

- A)III only.

B)II and III only.

C)II and IV only.

D)I only.