Hi,

These values are taken from the P1.T1.Amnec_Ch4.xls under the RAPM tab.

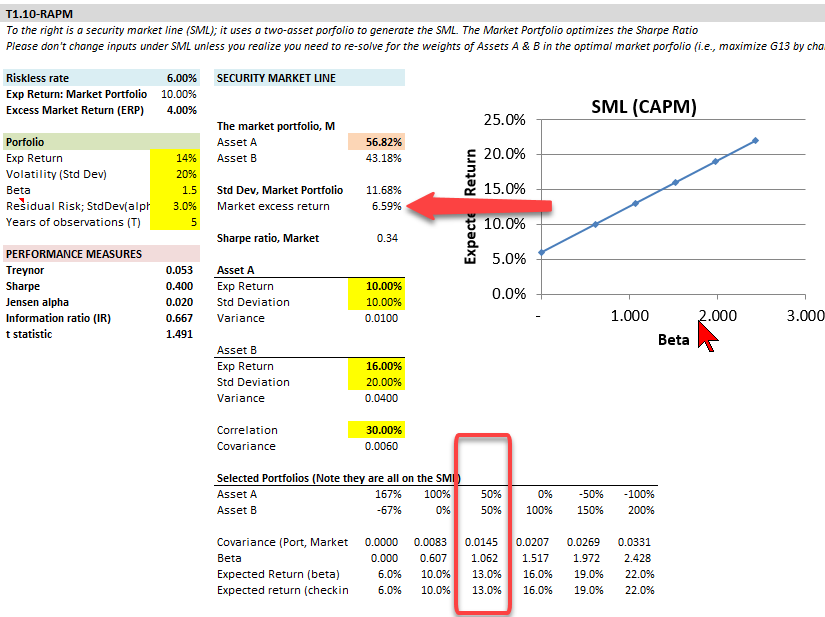

Asset A - 50%

Asset B - 50%

Covariance (Port, Market) - 0.0135

Beta - 1.062

Expected Return (beta) - 10.4% ( calculated from SML i.e. Rf+Beta*(Rm-Rf)

Expected return (checking) - 12.5% ( calculated by taking Xa*Ra+Xb*Rb)

I am not able to understand the concept of expected return. As in if I own a portfolio with Xa=0.5 and Xb=0.5 what will be my Expected return? What does the Expected return (beta) signify and what does the return (checking) signify?

Thanks

Manas

These values are taken from the P1.T1.Amnec_Ch4.xls under the RAPM tab.

Asset A - 50%

Asset B - 50%

Covariance (Port, Market) - 0.0135

Beta - 1.062

Expected Return (beta) - 10.4% ( calculated from SML i.e. Rf+Beta*(Rm-Rf)

Expected return (checking) - 12.5% ( calculated by taking Xa*Ra+Xb*Rb)

I am not able to understand the concept of expected return. As in if I own a portfolio with Xa=0.5 and Xb=0.5 what will be my Expected return? What does the Expected return (beta) signify and what does the return (checking) signify?

Thanks

Manas