Head on over to our Facebook page to enter our Trivia Contest! You will be entered to win a $15 gift card of your choice from Starbucks, Amazon or iTunes (iTunes is US only)!

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

(Note: All participants will be entered into our random drawing regardless of correct or incorrect answers. There will be two winners drawn at random.)

The price of a two-year zero-coupon government bond is $96.68. The price of a similar three-year bond is $93.13. If rates are given with an annual compound frequency, which is nearest to the one-year implied forward rate from year two to year three?

a .2.75%

b. 3.81%

c. 4.60%

d. 5.35%

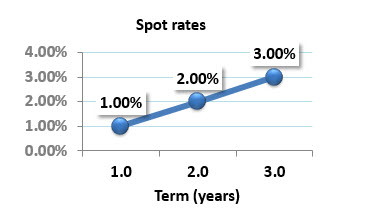

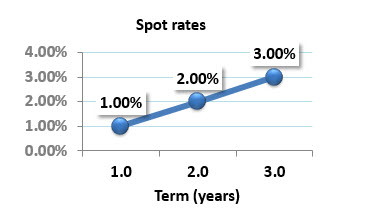

Assume the following spot rate curve (rate are given with annual compound frequency):

Which is nearest to the yield-to-maturity (YTM) of a three-year bond that pays an annual coupon with a coupon rate of 4.0%?

a. 1.50%

b. 1.83%

c. 2.94%

d. 3.76%

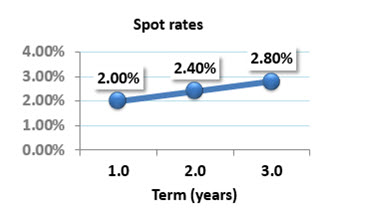

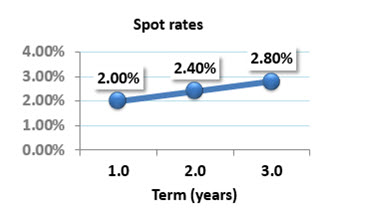

Assume the following spot rate curve (rates given with annual compound frequency):

Consider two bonds :

a. Both prices decrease

b. Bond A increases in price, while Bond B decreases in price

c. Bond A decreases in price, while Bond B increases in price

d. Both prices increase

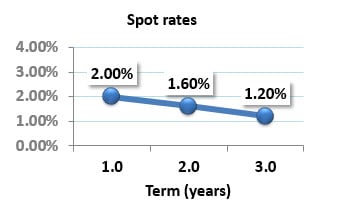

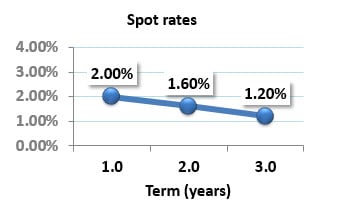

Assume the following spot rate curve (rates given with annual compound frequency):

Each of the following is true about this downward-sloping spot rate curve EXCEPT which is false?

a. A three-year bond the pays an annual coupon of 2.0% has a price of about $102.31

b. A three-year bond the pays an annual coupon of 2.0% has yield (YTM) of about 1.210%

c. As the yield (YTM) is an average of spot rates, the yield is not variant to (does not depend on) the bond's coupon rate

d. If a three-year bond prices to par, over the next year (as its maturity decreases to two years), if the spot rate curve is static, the bond's price will decrease

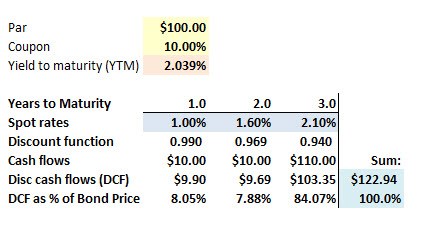

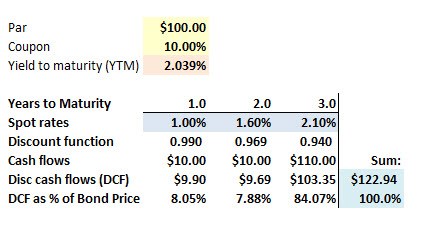

Consider the following a three-year bond that pays a 10.0% annual coupon while the spot rate curve is upward sloping:

The bond's price (which is the sum of its discounted cash flows) is $122.94. Which is nearest to the bond's Macaulay duration?

a. 1.84 years

b. 2.76 years

c. 3.00 years

d. 3.15 years

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

(Note: All participants will be entered into our random drawing regardless of correct or incorrect answers. There will be two winners drawn at random.)

The price of a two-year zero-coupon government bond is $96.68. The price of a similar three-year bond is $93.13. If rates are given with an annual compound frequency, which is nearest to the one-year implied forward rate from year two to year three?

a .2.75%

b. 3.81%

c. 4.60%

d. 5.35%

Assume the following spot rate curve (rate are given with annual compound frequency):

Which is nearest to the yield-to-maturity (YTM) of a three-year bond that pays an annual coupon with a coupon rate of 4.0%?

a. 1.50%

b. 1.83%

c. 2.94%

d. 3.76%

Assume the following spot rate curve (rates given with annual compound frequency):

Consider two bonds :

- Bond A is a three-year bond that pays an annual coupon with coupon rate of 2.0%

- Bond B is a three-year bond that pays an annual coupon with coupon rate of 6.0%

a. Both prices decrease

b. Bond A increases in price, while Bond B decreases in price

c. Bond A decreases in price, while Bond B increases in price

d. Both prices increase

Assume the following spot rate curve (rates given with annual compound frequency):

Each of the following is true about this downward-sloping spot rate curve EXCEPT which is false?

a. A three-year bond the pays an annual coupon of 2.0% has a price of about $102.31

b. A three-year bond the pays an annual coupon of 2.0% has yield (YTM) of about 1.210%

c. As the yield (YTM) is an average of spot rates, the yield is not variant to (does not depend on) the bond's coupon rate

d. If a three-year bond prices to par, over the next year (as its maturity decreases to two years), if the spot rate curve is static, the bond's price will decrease

Consider the following a three-year bond that pays a 10.0% annual coupon while the spot rate curve is upward sloping:

The bond's price (which is the sum of its discounted cash flows) is $122.94. Which is nearest to the bond's Macaulay duration?

a. 1.84 years

b. 2.76 years

c. 3.00 years

d. 3.15 years

). If you really can't wait, here is the underlying XLS that I prepared (for backup), which contains the correct answers in

). If you really can't wait, here is the underlying XLS that I prepared (for backup), which contains the correct answers in